The US dollar eased slightly yesterday even after the US released some solid numbers. In October, the Producer Price Index (PPI) came in at 1.1%, which was better than the estimated 0.9%. It rose by 0.4% on a MoM basis after declining by -0.3% in the previous month. The market also received data from Walmart. The company recorded an annual growth of 3.2%, with its e-commerce division soaring by 41%. Walmart is an important company because it predicts trends in consumer spending. The market will receive October retail sales later today. The market expects the core retail sales to increase by 0.4% and headline retail sales numbers to increase by 0.2%.

EUR/USD Technical Analysis

Table of Contents

The EUR/USD pair rose to a high of 1.1030 on positive data from Europe. It also reacted to Jerome Powell’s testimony to Congress. The pair is trading at 1.1025, which is along the 50% Fibonacci Retracement level. The price is slightly below the upper side of the Bollinger Bands. The RSI rose to 51. The pair may see some major movements as Europe and the US release inflation numbers and retail sales today.

Crude Oil Rises as OPEC Trims Output Growth

The price of crude oil declined after OPEC released its monthly report. The cartel lowered oil production growth forecast for non-OPEC members for 2020. The report said that the US will produce less crude oil in the year. It now forecasts that oil production will drop by 34k a day to 2.17 million barrels. The US has revised production by 33k a day. Meanwhile, data from EIA showed that inventories rose by 2.2 million barrels in the past week. This was higher than the 1.649 million that traders were expecting.

XTI/USD Technical Analysis

The XTI/USD pair declined yesterday from a high of 57.85 to a low of 56.73. The pair is now trading at 57.15. The price is slightly below the middle line of the Bollinger Bands while the RSI remains at the neutral level of 50. The pair may attempt to move higher to retest the previous high of 57.82.

Euro Awaits Inflation Numbers

Traders will receive European inflation numbers for the month of October. The market expects consumer prices to have risen by an annualised rate of 0.7% and a MoM rate of 0.2%. The core CPI, which strips the volatile food and energy prices, is expected to remain unchanged at 1.1%. These numbers are below the ECB target of 2.0%. The European data released this week has shown some improvements. The GDP data showed that the economy expanded by 1.2%, which was higher than the consensus estimates of 1.1%. In Germany, the economy narrowly avoided a recession.

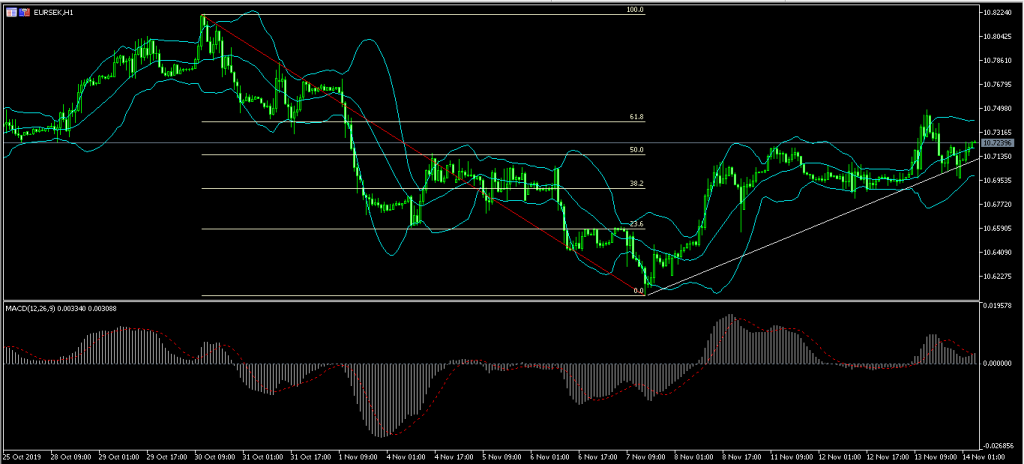

EUR/SEK Technical Analysis

The EUR/SEK pair declined to a low of 10.6550 as the Riksbank seemed set to move from negative interest rates. On the hourly chart, the pair has moved from a high of 10.7488. The price is below the 14-day and 28-day moving averages. The RSI has moved to a low of 26. The signal line of the MACD has been dropping. The pair may continue to decline.

The post US Dollar Eases as Retail Sales Data Improves 15/11/19 appeared first on FP Markets.