US stocks ended the day higher on Friday as traders reflected on the non-farm payrolls data. The numbers, released by the Labor Department, showed that the economy added more than 135k jobs in September. This was slightly lower than the consensus estimates of more than 145k jobs. The unemployment rate dropped to a 50-year low of 3.5%. The U6 unemployment rate, which includes people working part-time, dropped to 6.9%. Traders interpreted the numbers as being relatively positive at a time when the economy is showing signs of weakness.

GBP/USD. The GBP/USD pair was unchanged ahead of the Halifax house price index. The numbers are expected to show that house prices rose by 1.6% in September. This will be slightly lower than the previous increase of 1.8%. On an MoM basis, house prices are expected to have increased by 0.1%, which will be slightly lower than the previous increase of 0.3%. House prices have cooled down in recent months as uncertainty over Brexit has continued. Over the weekend, Brussels said that it would reject the proposal by Boris Johnson.

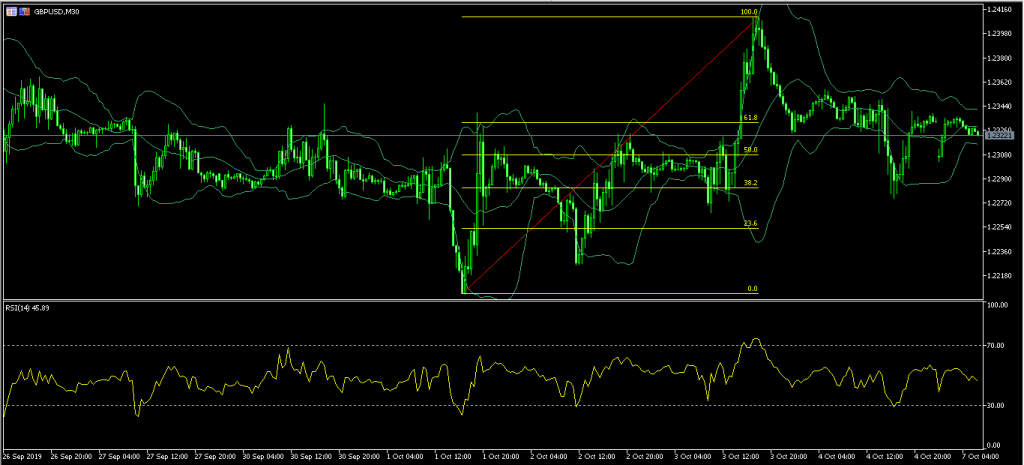

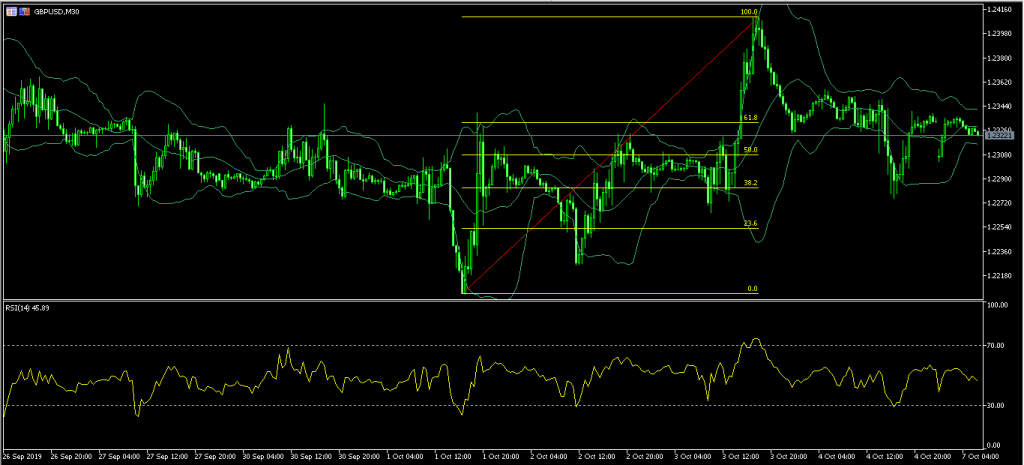

As of writing, the GBP/USD pair

is trading at 1.2324. On the hourly chart, this price is slightly below the

61.8% Fibonacci Retracement level and along the middle line of Bollinger Bands.

The RSI has remained unchanged at 47. The pair will likely retest the 50%

Fibonacci Retracement level of 1.2300.

EUR/USD. The EUR/USD pair declined slightly as traders started to focus on the upcoming trade talks between the United States and China. The trade talks will kick off on Thursday this week. The talks resume at a time when both the US and China are seeing major weaknesses in their economies. Just last week, US manufacturing PMI data showed that activity declined to a 50-year low. China too is in a manufacturing recession. Still, traders don’t believe that the two countries will do a deal. Just two weeks ago, Chinese officials canceled a trip to meet US farmers due to disagreements with US negotiators.

The EUR/USD pair declined to a

low of 1.0977. On the hourly chart below, the price is slightly below the

14-day and 25-day exponential moving averages. The RSI has declined slightly to

a low of 45 while the on-balance volume has flattened. The pair could see some

major movements in either direction as traders keep an eye out for more

information on trade.

AUD/USD. The Australian

dollar declined sharply today as traders start thinking of the next actions to

be taken by the RBA. Last week, the Australian central bank slashed interest

rates by another 25-basis points. This brought the total rate cuts to 75-basis

points. While the rate cuts were welcome, traders have started to wonder what

will happen next as the world economy continues to see slow growth. This week’s

talks between the United States and China will be crucial. A deal or a mere détente

could lead to a market rally, which could have a positive impact on the Aussie.

The AUD/USD pair declined from a

high of 0.6775 to the current low of 0.6745. The pair is trading below the

13-day and 25-day moving averages while the RSI has been on a downward trend to

37. This is an indication that the pair could continue moving lower to the

61.8% Fibonacci level of 0.6735.

The post Aussie Falls Ahead of Fresh US-China Trade Talks 07/10/19 appeared first on FP Markets.