Molero DEALS

Table of Contents

Author: Maria Gonzalez

Introduction

In this review, I will provide an in-depth analysis of Molero, drawing on my experience as a professional trader and financial analyst. With a background in trading across diverse markets in Asia, Europe, and the Americas, I aim to offer a global perspective on Molero’s offerings and evaluate its strengths and weaknesses.

Methodology

To ensure a comprehensive and unbiased review, I utilized the following methodology:

- Platform Testing: I tested Molero’s trading platforms (WebTrader, Mobile Trader, and Desktop Trader) to assess their usability, features, and performance.

- Account Analysis: I examined the different account types offered by Molero, evaluating the minimum deposit requirements, available features, and suitability for various types of traders.

- Asset Evaluation: I analyzed the range of assets available for trading on Molero, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

- Fee Structure: I reviewed Molero’s spreads, commissions, and swap fees to determine the cost-effectiveness of trading on the platform.

- Customer Support: I interacted with Molero’s customer support team to evaluate the responsiveness and helpfulness of their service.

- Security Measures: I investigated the security protocols in place to protect traders’ funds and personal information.

- Educational Resources: I assessed the educational materials provided by Molero to support traders in their trading journey.

Trading Platforms and Trading Tools: An In-Depth Look

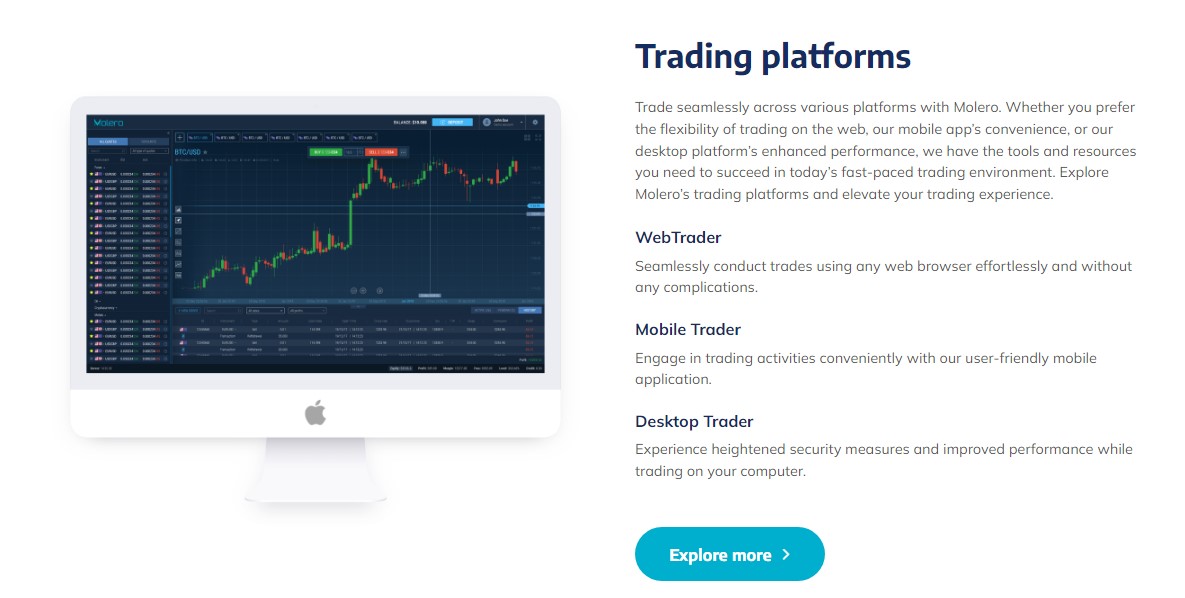

Trading Platforms

One of the standout features of Molero is its diverse range of trading platforms designed to cater to the needs of all types of traders. Whether you’re a beginner looking for simplicity or a seasoned professional needing advanced tools, Molero’s platforms have something to offer.

WebTrader

Molero’s WebTrader platform is a versatile option accessible directly from any web browser, eliminating the need for software installation. This is particularly beneficial for traders who need quick and easy access to the markets without the hassle of downloading and maintaining software. The WebTrader platform features an intuitive interface that is both user-friendly and powerful. Real-time streaming quotes and interactive charts provide comprehensive market analysis, making it an ideal choice for traders who need immediate market access and detailed analytics on the fly.

Mobile Trader

In today’s fast-paced trading environment, having the ability to trade on the go is crucial. Molero’s Mobile Trader app is designed to provide full trading capabilities from your smartphone or tablet. The app offers real-time market data and lightning-fast transaction processing, ensuring that you can react to market movements instantly, no matter where you are. The user-friendly interface makes it easy to execute trades, manage your account, and analyze market trends. The Mobile Trader app integrates seamlessly with Molero’s other platforms, allowing for a continuous and flexible trading experience.

Desktop Trader

For traders who prefer a more robust and comprehensive trading environment, Molero’s Desktop Trader platform is the go-to choice. This platform is designed for serious traders who need advanced features and enhanced security. It supports multi-monitor setups, allowing for detailed and expansive market analysis across several screens. The Desktop Trader platform includes advanced charting tools, technical indicators, and customizable layouts, providing a rich set of features for in-depth technical analysis. Integration with Molero’s research and analysis resources ensures that traders have access to the latest market insights and data, enhancing their trading strategies.

Trading Tools

Molero doesn’t just provide platforms; it also offers a wide array of trading tools that empower traders to make informed decisions and execute their strategies effectively.

Advanced Charting Tools

One of the most critical aspects of successful trading is the ability to analyze market trends and price movements. Molero’s platforms come equipped with advanced charting tools that allow traders to visualize data in various formats, including line charts, bar charts, and candlestick charts. These tools enable traders to apply technical analysis techniques such as trend lines, support and resistance levels, and various chart patterns to predict future price movements.

Technical Indicators

Molero offers a comprehensive suite of technical indicators, which are essential for analyzing market conditions and identifying trading opportunities. These include moving averages, relative strength index (RSI), Bollinger Bands, MACD (Moving Average Convergence Divergence), and many more. These indicators help traders to identify trends, measure market momentum, and determine overbought or oversold conditions, thereby facilitating more informed trading decisions.

Economic Calendar

Keeping track of economic events is vital for forex traders, as these events can significantly impact market volatility. Molero provides an integrated economic calendar that lists upcoming economic events, such as GDP releases, employment reports, and central bank meetings. This tool helps traders to stay informed about events that could affect the markets and plan their trading strategies accordingly.

News Feed

Molero’s platforms include a real-time news feed that provides the latest market news and updates. This feature is crucial for traders who need to stay updated on global economic trends, political events, and other factors that could influence the markets. By having access to timely and relevant news, traders can make quick decisions and capitalize on market opportunities.

Market Analysis Reports

To further support its traders, Molero offers detailed market analysis reports. These reports provide insights into market trends, potential trading opportunities, and strategic advice. Compiled by experienced analysts, these reports can be a valuable resource for both novice and experienced traders looking to enhance their market understanding and trading performance.

Customizable Trading Environment

Molero understands that every trader has unique preferences and strategies. Therefore, the platforms are highly customizable, allowing traders to tailor their trading environment to suit their individual needs. This includes the ability to adjust chart settings, set up personalized watchlists, and configure alerts for specific market conditions.

Molero.io Trading Accounts

Molero offers a variety of trading accounts tailored to meet the diverse needs of traders, from beginners to seasoned professionals. Here’s a detailed look at each account type, highlighting the key features and requirements.

Basic Account

The Basic account is Molero’s entry-level offering, requiring a minimum deposit of $5,000. This account is designed for new and small-scale traders. Key features include:

- Negative Balance Protection: Ensures that traders cannot lose more than their initial investment.

- Variable Spreads: Competitive spreads that can vary depending on market conditions.

- Access to Over 250 Instruments: Includes currency pairs, commodities, and indices.

- Support: 24/5 customer support is available, although a personal account manager is not included.

This account provides essential tools and resources for those starting their trading journey, offering a solid foundation to build upon.

Standard Account

The Standard account requires a minimum deposit of $25,000, making it suitable for more experienced traders. It includes all the features of the Basic account with additional benefits:

- Larger Trade Sizes: Allows for trading up to 20 lots, providing more flexibility in trading volume.

- Enhanced Support: While it does not include a personal account manager, 24/5 support ensures traders can get assistance when needed.

This account type is ideal for traders looking to expand their trading activities and take advantage of larger market opportunities.

Pro Account

Designed for professional traders, the Pro account requires a minimum deposit of $100,000. This account offers advanced features to meet the needs of serious traders:

- Higher Leverage: Up to 200, allowing for greater potential returns.

- Larger Trade Sizes: Trade up to 40 lots.

- Personal Account Manager: Dedicated support to provide personalized trading advice and assistance.

The Pro account is suited for those who need more substantial trading capabilities and personalized support.

Gold Account

The Gold account is a premium offering with a minimum deposit of $250,000. It includes all the features of the Pro account plus additional benefits:

- Maximum Leverage: Up to 500, offering significant trading power.

- Enhanced Support: 24/5 support with access to a personal account manager.

- Exclusive Resources: Additional tools and resources to enhance trading strategies.

This account is tailored for high-net-worth individuals seeking extensive trading options and premium support.

Exclusive Account

The Exclusive account is Molero’s top-tier offering, requiring a minimum deposit of $1,000,000. It provides all the benefits of the Gold account with even more advantages:

- 24/7 Support: Around-the-clock support from a dedicated team.

- Highest Trade Sizes: Ability to trade up to 100 lots.

- Elite Resources: Access to exclusive trading tools and insights.

The Exclusive account is designed for the most demanding traders, offering unparalleled support and resources to maximize trading potential.

What You Can Trade

Molero offers an extensive range of trading instruments, providing traders with the opportunity to diversify their portfolios and explore various market opportunities. Here’s a detailed look at what you can trade on Molero’s platform.

Forex Pairs

Forex trading is one of Molero’s core offerings, with access to major, minor, and exotic currency pairs. This variety allows traders to capitalize on global economic trends and fluctuations in exchange rates. Key features include:

- Major Pairs: Such as EUR/USD, GBP/USD, and USD/JPY, which offer high liquidity and tighter spreads.

- Minor Pairs: Including EUR/GBP and AUD/JPY, which provide opportunities beyond the major economies.

- Exotic Pairs: Like USD/TRY and EUR/ZAR, which can offer higher volatility and potential for significant gains.

Commodities

Molero provides access to a range of commodities, enabling traders to hedge against inflation or speculate on global economic trends. The commodities market is divided into:

- Precious Metals: Gold and silver, which are often seen as safe-haven assets.

- Energy Commodities: Crude oil and natural gas, which are influenced by geopolitical events and supply-demand dynamics.

- Agricultural Products: Such as wheat, corn, and coffee, which are affected by weather conditions and global demand.

Indices

Trading indices with Molero allows traders to speculate on the performance of a group of stocks from a particular country or sector. This can include:

- Major Global Indices: Such as the S&P 500, NASDAQ, FTSE 100, and DAX 30.

- Sector Indices: Focused on specific industries like technology or healthcare, providing targeted exposure.

Stocks

Molero offers access to shares of major global companies, allowing traders to invest in individual stocks. This includes:

- Blue-Chip Stocks: From well-established companies with a history of performance.

- Growth Stocks: Companies with potential for significant growth, often found in emerging sectors like technology.

- Dividend Stocks: Providing regular income through dividends, suitable for long-term investors.

Cryptocurrencies

Molero supports trading in several cryptocurrencies, offering exposure to this rapidly evolving market. Key cryptocurrencies available include:

- Bitcoin (BTC): The most well-known and widely traded cryptocurrency.

- Ethereum (ETH): Known for its smart contract functionality.

- Litecoin (LTC): Often considered the silver to Bitcoin’s gold.

- Other Cryptocurrencies: Including Ripple (XRP) and Bitcoin Cash (BCH), among others.

CFDs on a Range of Assets

Contracts for Difference (CFDs) allow traders to speculate on the price movements of various assets without owning the underlying asset. Molero offers CFDs on:

- Forex Pairs: Offering leveraged trading opportunities.

- Commodities: Allowing traders to benefit from price movements in energy, metals, and agricultural products.

- Indices and Stocks: Providing exposure to broad market movements and individual company performance.

- Cryptocurrencies: Enabling traders to speculate on digital asset prices with leverage

Regulation and Security and Safety

Regulation

One of the most critical aspects to consider when choosing a forex broker is its regulatory status. Molero operates as an unregulated CFD brokerage, which means it does not fall under the jurisdiction of any financial regulatory body. While this allows for more flexibility in its operations and offerings, it also raises concerns about the level of oversight and protection provided to traders.

The absence of regulation means that traders must exercise caution and conduct thorough research before committing to using Molero. The broker emphasizes transparency and ethical practices, but the lack of formal regulation may be a significant drawback for some traders, particularly those who prioritize the security and oversight provided by regulated entities.

Security and Safety Measures

Despite being unregulated, Molero strongly emphasizes the security and safety of its traders’ funds and personal information. The platform has implemented several robust measures to ensure a secure trading environment.

Encryption Technology

Molero employs state-of-the-art encryption technology to protect sensitive data. This includes securing personal information, financial transactions, and communication between traders and the platform. By using advanced encryption protocols, Molero ensures that all data transmitted over the network is safe from unauthorized access and cyber threats.

Multi-Factor Authentication

To add an extra layer of security, Molero offers multi-factor authentication (MFA) for account access. MFA requires traders to provide two or more verification methods before gaining access to their accounts. This significantly reduces the risk of unauthorized access, even if a trader’s password is compromised.

Secure Payment Methods

Molero supports a variety of secure payment methods for deposits and withdrawals, including wire transfers, credit cards, and automated instant withdrawal methods. These methods are chosen for their reliability and security, ensuring that traders can fund their accounts and access their profits without unnecessary risk.

Data Protection Policies

Molero has stringent data protection policies in place to safeguard traders’ personal information. These policies comply with international data protection standards, ensuring that all personal and financial data is handled responsibly and securely. The platform regularly reviews and updates its data protection measures to adapt to evolving security threats.

Risk Management Tools

Molero provides various risk management tools to help traders protect their capital and manage their exposure. These tools include stop-loss orders, take-profit orders, and margin requirements. By using these tools, traders can set predetermined levels at which their trades will be automatically closed, minimizing potential losses in volatile market conditions.

Account Segregation

Molero practices account segregation, which means that traders’ funds are kept separate from the company’s operational funds. This ensures that even in the unlikely event of Molero facing financial difficulties, traders’ funds remain protected and accessible.

Regular Security Audits

To maintain high-security standards, Molero conducts regular security audits and assessments. These audits help identify potential vulnerabilities and ensure that all security measures are up-to-date and effective. By continuously monitoring and improving its security infrastructure, Molero demonstrates its commitment to providing a safe trading environment.

summary

While Molero operates as an unregulated brokerage, it compensates for this with a strong focus on security and safety measures. The use of advanced encryption technology, multi-factor authentication, secure payment methods, and stringent data protection policies helps build trust among traders. Additionally, risk management tools and account segregation provide further reassurance that traders’ funds and personal information are well-protected. Despite the lack of regulation, Molero’s robust security measures make it a viable option for traders who prioritize a secure trading environment.

Fees, Commissions, Costs, and Deposit and Withdrawal Options

Fees and Commissions

Molero offers a competitive fee structure designed to appeal to a wide range of traders. The brokerage primarily operates on a spread-based model, but certain account types also incorporate commissions. Here’s a detailed breakdown of the costs associated with trading on Molero:

Spreads: Molero provides variable spreads that can start as low as 0.1 pips for major forex pairs. The exact spread can vary depending on market conditions and the account type.

Commissions: While many trades are covered by the spread, some accounts, particularly higher-tier ones like the Pro and Exclusive accounts, may incur commissions. These commissions are transparent and clearly outlined for traders, ensuring there are no hidden costs.

Swap Fees: Overnight positions are subject to swap fees (or rollover fees), which are standard in the industry. These fees are charged based on the interest rate differential between the currencies being traded.

Additional Costs: Molero prides itself on transparency, with no hidden fees. However, traders should be aware of potential costs such as withdrawal fees, especially for bank transfers.

Deposit and Withdrawal Options

Molero offers a variety of methods for both depositing funds into trading accounts and withdrawing profits, ensuring flexibility and convenience for its global clientele.

Deposit Options:

- Wire Transfers: Secure and reliable, though processing times can vary depending on the banks involved.

- Credit and Debit Cards: Instant deposits, making it easy for traders to start trading without delay.

- E-Wallets: Molero supports various e-wallet options, providing quick and convenient funding methods.

- Automated Instant Methods: Some methods offer near-instant deposits, enhancing convenience for traders.

Withdrawal Options:

- Wire Transfers: While secure, these can sometimes take a few business days to process.

- Credit and Debit Cards: A convenient option for many traders, though withdrawal times can vary.

- E-Wallets: Typically faster than traditional banking methods, e-wallets can provide quicker access to funds.

- Instant Withdrawal Methods: For eligible accounts and methods, Molero offers instant withdrawals, ensuring traders can access their profits without delay.

Processing Times and Fees:

- Processing Times: Deposits are generally processed quickly, especially via credit cards and e-wallets. Withdrawals may take longer, particularly if processed through bank transfers, but Molero aims to handle requests promptly.

- Fees: While deposits are often free, withdrawals may incur fees, particularly for bank transfers. Molero is transparent about these charges, which vary depending on the method and the amount being transferred.

Account Funding Security

Molero employs robust security measures to protect financial transactions. This includes encryption technology to safeguard payment information and ensure that deposits and withdrawals are processed securely.

Conclusion

Molero provides a competitive and transparent fee structure, with variable spreads and clear commission details. The range of deposit and withdrawal options offers flexibility for traders worldwide, ensuring they can manage their funds efficiently. While some methods may incur fees, Molero’s commitment to transparency means traders are always aware of any costs involved. Overall, Molero’s financial and banking options are designed to facilitate a smooth and secure trading experience.

Pros and Cons of Molero

Pros:

- Advanced Trading Platforms: Molero offers a range of platforms (WebTrader, Mobile Trader, Desktop Trader) that cater to different trading styles and needs, ensuring flexibility and accessibility.

- Comprehensive Asset Variety: Traders can access over 200 CFDs, including forex pairs, commodities, indices, stocks, and cryptocurrencies, allowing for diversified trading strategies.

- Competitive Spreads: Starting as low as 0.1 pips for major forex pairs, Molero’s spreads are competitive, making it cost-effective for traders.

- Robust Security Measures: Despite being unregulated, Molero employs advanced encryption, multi-factor authentication, and stringent data protection policies.

- Flexible Deposit and Withdrawal Options: A variety of secure methods are available, including wire transfers, credit cards, e-wallets, and instant methods.

- Excellent Customer Support: Available 24/7 for Exclusive accounts and 24/5 for other accounts, with multiple support channels and multilingual assistance.

- Educational Resources: Molero provides extensive resources such as tutorials, webinars, and market analysis reports to help traders improve their skills.

- Risk Management Tools: Features like stop-loss orders, take-profit orders, and margin requirements help traders manage their risk effectively.

- Customizable Trading Environment: Platforms offer customizable layouts and settings, allowing traders to personalize their trading experience.

- Transparent Fee Structure: Clear and straightforward fees with no hidden costs, ensuring traders know exactly what they are paying.

Cons:

- Unregulated Status: Molero is an unregulated brokerage, which can be a significant concern for traders who prioritize regulatory oversight and protection.

- High Minimum Deposits for Premium Accounts: Minimum deposits for Pro, Gold, and Exclusive accounts are quite high, which may be prohibitive for some traders.

- Potential Withdrawal Fees: Certain withdrawal methods, especially bank transfers, may incur fees.

- Limited Account Management for Lower-Tier Accounts: Basic and Standard accounts do not include personal account managers.

- Market Risk with High Leverage: High leverage options can lead to significant losses, particularly for inexperienced traders.

Arguments and Counterarguments to the Cons:

Unregulated Status:

- Argument: The lack of regulation can raise concerns about the safety and trustworthiness of the broker.

- Counterargument: Molero compensates for its unregulated status with robust security measures, including advanced encryption, multi-factor authentication, and strict data protection policies. These measures ensure that traders’ funds and personal information are well-protected. Additionally, the platform emphasizes transparency and ethical practices, which help build trust despite the absence of formal regulation.

High Minimum Deposits for Premium Accounts:

- Argument: The high minimum deposits required for Pro, Gold, and Exclusive accounts may exclude smaller traders from accessing premium features.

- Counterargument: While the minimum deposits are high, these accounts offer substantial benefits, including higher leverage, larger trade sizes, personal account managers, and enhanced support. For serious traders and high-net-worth individuals, these features can justify the higher initial investment by providing better trading conditions and support.

Potential Withdrawal Fees:

- Argument: Withdrawal fees, especially for bank transfers, can reduce overall profitability.

- Counterargument: Molero’s transparent fee structure ensures that traders are fully aware of any potential costs associated with withdrawals. Additionally, the availability of multiple withdrawal methods allows traders to choose the most cost-effective option. Fees for faster, more secure withdrawal methods are often standard in the industry and reflect the additional security and speed provided.

Limited Account Management for Lower-Tier Accounts:

- Argument: Basic and Standard accounts do not come with personal account managers, which might limit support for these traders.

- Counterargument: Even without personal account managers, Molero provides 24/5 customer support for all account types. The extensive educational resources and risk management tools available to all traders help bridge the support gap. As traders grow and potentially move to higher-tier accounts, they gain access to more personalized support.

Market Risk with High Leverage:

- Argument: High leverage options can lead to significant losses, particularly for inexperienced traders.

- Counterargument: While high leverage does increase risk, it also offers the potential for higher returns. Molero provides various risk management tools, such as stop-loss orders and margin requirements, to help traders mitigate these risks. Additionally, educational resources and detailed market analysis can equip traders with the knowledge to use leverage responsibly.

Molero presents a strong offering with advanced trading platforms, comprehensive asset variety, competitive spreads, and robust security measures. While the unregulated status and high minimum deposits for premium accounts are notable drawbacks, the platform’s extensive features, transparent fee structure, and excellent customer support provide significant advantages. By addressing the cons with appropriate counterarguments, Molero demonstrates a commitment to providing a secure and supportive trading environment, making it a viable option for traders who can navigate its unique characteristics.

Conclusion Molero Review

Molero has emerged as a noteworthy player in the world of forex trading, offering a range of features designed to meet the needs of diverse traders. From advanced trading platforms and a comprehensive array of trading instruments to robust security measures and competitive fee structures, Molero has built a compelling case for itself. However, it is essential to evaluate both the strengths and potential drawbacks to make an informed decision about whether this brokerage is the right fit for you.

Strengths of Molero

One of Molero’s most significant strengths is its advanced suite of trading platforms. Whether you prefer the flexibility of WebTrader, the mobility of Mobile Trader, or the comprehensive features of Desktop Trader, Molero has a platform to suit your trading style. Each platform is designed with user experience in mind, offering intuitive interfaces, real-time data, and a wealth of analytical tools. This versatility ensures that traders can access the markets seamlessly, whether they are at home, in the office, or on the move.

Considerations and Counterarguments

While Molero offers many strengths, there are some considerations to keep in mind. The unregulated status of the broker may be a concern for some traders who prioritize regulatory oversight and protection. However, the robust security measures and transparent operations can mitigate some of these concerns, providing a level of trust and reliability.

The high minimum deposits required for premium accounts may also be a barrier for some traders. While these accounts offer substantial benefits, such as higher leverage, larger trade sizes, and personal account managers, the initial investment may be prohibitive. Traders need to weigh the advantages of these features against the cost to determine if they are worthwhile.

Potential withdrawal fees, especially for bank transfers, are another consideration. However, Molero’s transparent fee structure ensures that traders are aware of these costs upfront, allowing them to choose the most cost-effective withdrawal methods.

Final Thoughts

In conclusion, Molero presents a strong offering for traders looking for a versatile and feature-rich trading environment. The combination of advanced platforms, a wide range of trading instruments, competitive fees, and robust security measures makes it an attractive option. The educational resources and comprehensive customer support further enhance its appeal, providing traders with the tools and assistance they need to succeed.

While the lack of regulation and high minimum deposits for premium accounts are notable drawbacks, the benefits offered by Molero can outweigh these concerns for many traders. By providing transparent operations, extensive features, and a secure trading environment, Molero has positioned itself as a viable choice for traders willing to navigate the unique characteristics of an unregulated broker.

Ultimately, whether Molero is the right broker for you depends on your individual trading needs, risk tolerance, and investment goals. By considering the strengths and potential drawbacks discussed in this review, you can make an informed decision that aligns with your trading strategy and financial objectives. With its comprehensive offerings and commitment to security and support, Molero stands out as a broker that can provide a rewarding trading experience for those who choose to engage with it.

FAQ

What types of trading platforms does Molero offer?

Molero offers three main trading platforms: WebTrader, Mobile Trader, and Desktop Trader. Each platform is designed to cater to different trading needs, providing a range of features from real-time data and advanced charting tools to seamless integration with research resources.

Is Molero a regulated broker?

No, Molero operates as an unregulated CFD brokerage. While it offers robust security measures and transparent operations, it does not fall under the jurisdiction of any financial regulatory body.

What assets can I trade on Molero?

Molero provides access to over 200 CFDs, including forex pairs, commodities, indices, stocks, and cryptocurrencies. This wide variety allows traders to diversify their portfolios and explore different market opportunities.

What are the account types available at Molero?

Molero offers five account types: Basic, Standard, Pro, Gold, and Exclusive. These accounts cater to different trading needs and capital levels, with minimum deposits ranging from $5,000 to $1,000,000 and varying features such as leverage, trade sizes, and personal account managers.

What are the spreads and fees like on Molero?

Molero offers competitive spreads starting as low as 0.1 pips for major forex pairs. While many trades are covered by spreads, some account types may incur commissions. Additionally, swap fees are applicable for overnight positions, aligned with industry standards.

How can I deposit and withdraw funds from Molero?

Molero supports a variety of deposit and withdrawal methods, including wire transfers, credit cards, e-wallets, and instant withdrawal methods. Processing times and any associated fees vary depending on the chosen method.

Is my personal information secure with Molero?

Yes, Molero employs advanced encryption technology, multi-factor authentication, and stringent data protection policies to ensure the security of traders’ personal and financial information.

Does Molero offer any educational resources for traders?

Yes, Molero provides extensive educational resources, including tutorials, webinars, and market analysis reports. These resources are designed to help traders of all levels improve their skills and stay informed about market trends.

What kind of customer support does Molero offer?

Molero offers 24/7 customer support for Exclusive account holders and 24/5 support for other accounts. Support is available through multiple channels, including live chat, email, and phone, with multilingual assistance to cater to a global clientele.

Can I use leverage on Molero?

Yes, Molero offers leverage options depending on the account type. Basic accounts have standard leverage, while Gold and Exclusive accounts can access leverage up to 500. However, high leverage can increase both potential returns and risks, so it should be used responsibly.

How do I open an account with Molero?

Opening an account with Molero is straightforward. The process involves filling out an online application, submitting necessary identification documents, and funding the account. Molero’s verification procedures ensure that only legitimate traders can access the services.

About Forex Broker News

Author: “Maria Gonzalez is a professional trader and financial analyst with a unique global perspective, having traded in markets across Asia, Europe, and the Americas. With a Bachelor’s degree in International Business and a Master’s in Financial Analysis from London Business School, Maria specialises in currency pairs and emerging market assets. Her analysis is sought after in international trading forums and financial news outlets, where she provides insights into global economic trends and their impact on forex markets.

Risk Disclaimer: Trading Forex and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. It is possible to lose all your invested capital. Therefore, you should not invest money you cannot afford to lose. Before deciding to trade, you should fully understand the risks involved, consider your investment objectives and experience level, and seek independent advice if necessary. The past performance of trading instruments is not a reliable indicator of future results. Market conditions can change rapidly, and no guarantee is made that any account will or will likely achieve profits or losses similar to those discussed on this platform. Please be aware that we are not responsible for the privacy practices or content of other websites linked to or from our service. Trading on margin increases the financial risks. This disclaimer is not exhaustive and does not cover all possible risks associated with trading Forex and other leveraged products.

The Review

Molero

Molero is an unregulated CFD brokerage offering advanced trading platforms, a wide range of trading instruments, and robust security measures. It provides three main platforms: WebTrader, Mobile Trader, and Desktop Trader, catering to different trading needs with real-time data and advanced charting tools. Molero offers over 200 CFDs, including forex pairs, commodities, indices, stocks, and cryptocurrencies, allowing for diversified trading strategies.Despite being unregulated, Molero employs advanced encryption, multi-factor authentication, and stringent data protection policies. The broker's fee structure is transparent, with competitive spreads starting as low as 0.1 pips for major forex pairs and clear commissions.Traders can choose from five account types, with minimum deposits ranging from $5,000 to $1,000,000, each offering varying features like leverage, trade sizes, and personal account managers. Molero supports multiple deposit and withdrawal methods, ensuring flexibility and convenience.While the lack of regulation and high minimum deposits for premium accounts are drawbacks, Molero’s comprehensive offerings, extensive educational resources, and excellent customer support make it a strong contender for traders willing to navigate its unique characteristics. Overall, Molero provides a secure and supportive trading environment with significant potential for a rewarding trading experience.

PROS

- Advanced Trading Platforms

- Flexible Deposit and Withdrawal Options

- Comprehensive Asset Variety

- Competitive Spreads

- Excellent Customer Support

- Risk Management Tools

- Customizable Trading Environment

- Transparent Fee Structure

CONS

- High Minimum Deposits for Premium Accounts

- Potential Withdrawal Fees

- Limited Account Management for Lower-Tier Accounts:

- Market Risk with High Leverage

- Unregulated Status:

Review Breakdown

-

Molero Trading conditions

-

Molero Trading experience

-

Molero Trading tools and Platforms

-

Safety, Regulation and security

-

Fees , spread and commissions

-

Molero Customer Support

Molero DEALS

We collect information from many stores for best price available