Asian and

Australian stocks rose as traders started to focus on the upcoming trade talks

between China and the US. In Australia, the ASX 200 rose by 30 points while in

Japan, the Nikkei rose by 216 points. In China, the A50 and Shanghai indices

rose by 200 and 25 points respectively. This is as the Chinese markets reopened

after being closed for a week as the country celebrated its Independence Day.

Expectations for the current round of talks are really low because of the hard

positions the two countries have taken. Meanwhile, the US added 28 Chinese

firms to an entity list overnight, which will further infuriate the Chinese.

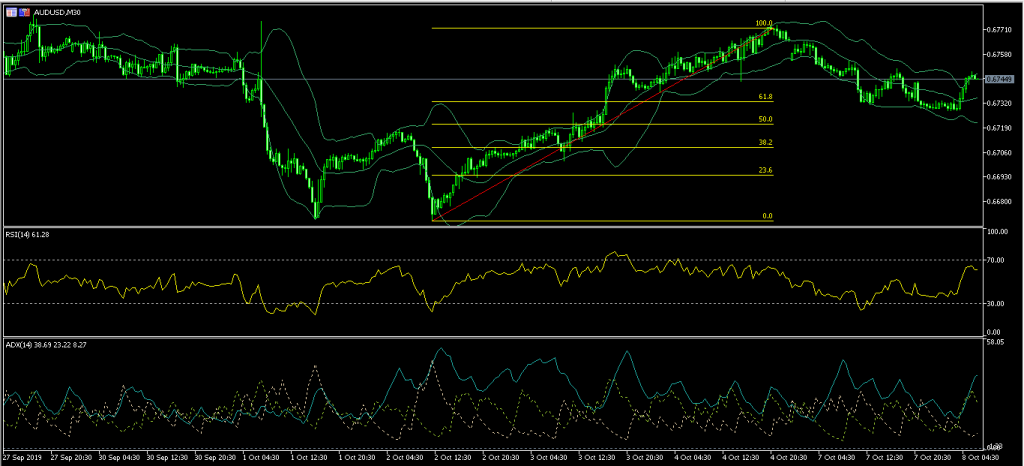

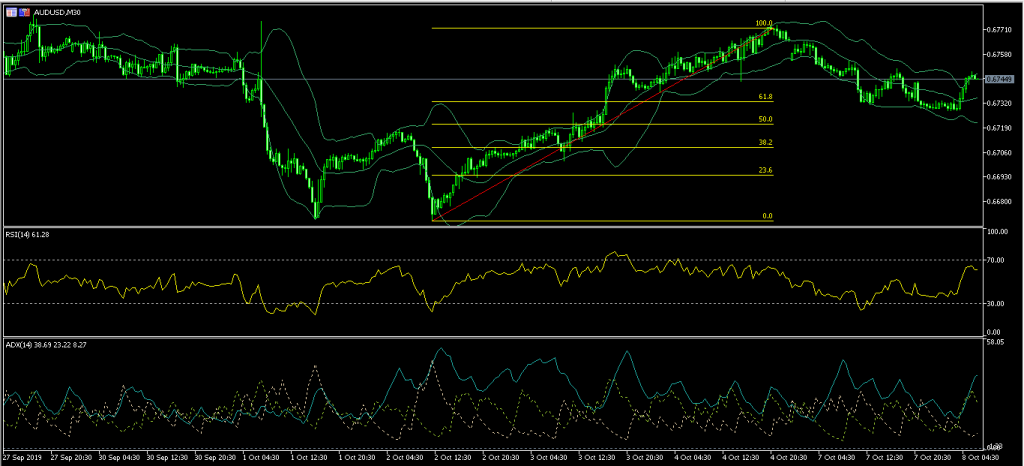

AUD/USD. The Australian dollar rose today even as China released relatively

weak services numbers. According to Caixin, China’s services PMI declined to

51.3 from the previous 52.1. This was another sign that the Chinese economy is

in a free fall. Earlier this month, the country’s manufacturing PMI remained in

a contraction mode. China is an important market for Australian goods.

According to the Bureau of Statistics, a third of all goods produced by

Australia are sold to China. This explains why Australia has not experienced a

recession for more than 27 years. Meanwhile, job advertisements in Australia

rose by 0.3% after declining by -2.6% in the previous month.

The AUD/USD pair

rose from a low of 0.6727 to a high of 0.6748. On the 30-minute chart, this

price is along the upper line of the Bollinger Bands while the RSI has moved

higher. The average directional index has moved higher to 38. There is a

possibility that the pair will continue moving higher to test the previous high

of 0.6775.

USD/JPY. The USD/JPY pair rose slightly in the Asian session as traders received the household income and spending data from Japan. According to the country’s statistics office, household spending rose by a percentage point in August. This was slightly below the consensus estimates of 1.2%. The spending rose by 2.4% on an MoM basis. On a positive note, the country’s surplus in the current account rose to $20 billion. This was the 62nd straight month of a positive number. Exports declined by 8.6% to Y6.08 trillion while imports declined by 12.7% to Y6.03 trillion. This is partly due to the weakening global growth, the weakness of the chip sector and the trade war between China and South Korea.

As of this

writing, the USD/JPY pair is trading at 107.36. On the 30-minute chart, this

price has moved above the 14-day and 28-day exponential moving averages. The

price is between the 50% and 38.2% Fibonacci Retracement level while the RSI

has remained slightly lower than the overbought level. The pair might continue

moving higher today.

EUR/USD. The EUR/USD pair was relatively unchanged ahead of the change in producer price data from the US. Analysts forecast that the core and headline PPI data remained unchanged at 2.3% and 1.8% in September. They expect the core PPI to have declined slightly from 0.3% to 0.2% on an MoM basis. The PPI data is an important measure of inflation. In addition, traders will listen to a statement from Jerome Powell and Chicago Fed President Charles Evans.

As of this

writing, the EUR/USD pair is trading at 1.0973. This is slightly higher than

yesterday’s low of 1.0964. On the 30-minute chart, the pair has been trading

within a channel ranging from 1.1000 and 1.0960. The envelopes indicator has

widened while the average true range indicator has moved lower. The pair will

likely move in reaction to the PPI data today.

The post Aussie rises ahead of US-China trade talks 08/10/19 appeared first on FP Markets.