Australian stocks rose sharply as the markets reacted to the latest trade news. These gains came a day after a phone call between the US and China trade representatives. China released a statement praising the talks as a positive move to resolve the ongoing trade skirmish between the two countries. Australia is relatively vulnerable to the trade talks because of its close trade relations with China. Stocks also rose after Rio Tinto announced that it would invest $749 million in its Greater Tom Price operations. Also, the market reacted to the resignation of Westpac CEO, days after the bank announced that it had made 23 million breaches of AML and terrorist finance laws.

AUS200 Technical Analysis

Table of Contents

The AUS200 index rose sharply to a high of $6850. This was the highest level since July 30 this year. The index has been on a sustained upward trend since December last year, when it was trading at $5410. The price is above the 14, 28, and 50-day exponential moving averages. The RSI has soared to 63 while the signal line of the MACD has continued to rise. The index may continue to rise.

Kiwi Jumps on Positive Trade Data

The New Zealand dollar rose after the statistics office released impressive October trade numbers. Data showed that exports rose by $206 million to $5 billion. This was a 4.3% increase. This surge was led by an increase of milk powder, which rose by 32% to $194 million. Exports of lamb rose by 27% while beef rose by 39%. The increase was offset by a decline of kiwifruit and untreated logs. Imports declined by $86 million to $6 billion. This was led by a decline of industrial transport equipment and processed industrial supplies. The monthly trade deficit was $1 billion. This was slightly below the average five-month deficit of $948 million. These numbers came a day after the country released impressive retail sales data.

AUD/NZD Technical Analysis

The AUD/NZD pair declined sharply as the market reacted to impressive trade data from New Zealand. The pair dropped to a low of 1.0543, which is the lowest level since August 22. The pair is below the 28-day and 14-day moving averages on the daily chart. The price is below the 50% Fibonacci Retracement level. The RSI has moved to the oversold level of 30. The pair may continue to move lower on positive outlook from New Zealand.

EUR/USD Pauses Ahead of Key Data

The EUR/USD was unchanged during the Asian session as the markets waited for key data from the European Union and the United States. The market will receive import price index data from Germany, household lending from Sweden, and jobseekers data from France. Key data will be from the United States released by the commerce department. This will include durable goods data, personal consumption expenditures, corporate profits for the third quarter, durable goods orders, jobless claims, real consumption spending and pending home sales among others.

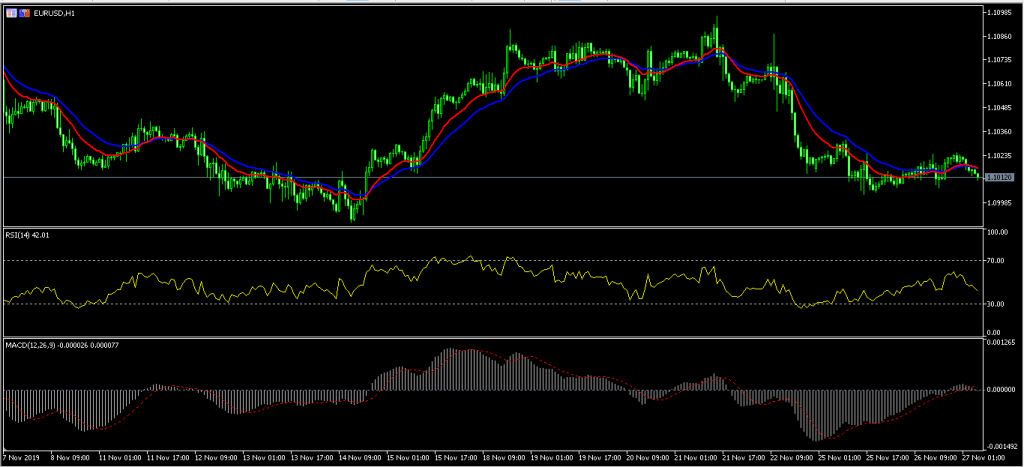

EUR/USD Technical Analysis

The EUR/USD pair has dropped from a high of 1.1087 to a low of 1.1000 this week. The pair dropped slightly from 1.1025 to a low of 1.1010. The RSI has dropped from a high of 59 to the current 25. The signal line of the MACD is along the consolidation level. The price is also along the 25-day and 14-day moving averages. All this is a sign of consolidation, which indicates that the pair may break out after the numbers today.

The post Australian Stocks Soar as Westpac CEO Resigns 27/11/19 appeared first on FP Markets.