Australian stocks rose after the RBA released its minutes for the previous meeting. The minutes showed that members were concerned about the slowing economy of the country’s trading partners. Just last week, China released fixed investments, manufacturing and industrial production data. Members expect the country’s main trading partners to grow by just 3.5%. As such, it warned that risks are tilted downwards. These minutes come at a time when the Australian government is being urged to offer more stimulus to boost the economy.

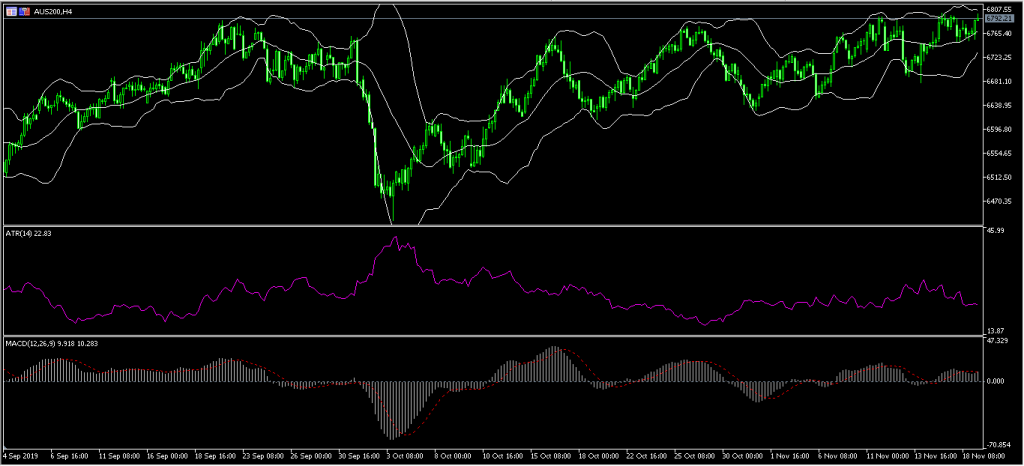

AUS200

Table of Contents

Australian stocks continued moving upwards and reached a high of $6798. This was an important support level. The price is slightly below the upper line of the Bollinger Bands. The average true range has dropped slightly. The signal and histograms of the MACD are trading slightly higher. The index may continue moving higher as the market continues to wait for a stimulus package.

US Stocks Rise Ahead of Retail Earnings

US futures rose as the market waited for earnings from a number of the country’s retailers. The companies to watch today will be Aramark, Kohl’s, Urban Outfitters and Home Depot. Other retailers expected to report this week are Lowe’s, Stein Mart, L Brands and Target among others. Results from retailers are important because they show the performance of the economy. Meanwhile, the market will receive housing starts and building permits data. The market expects building permits to decline from 1.391 million to 1.385 million while housing starts are expected to increase from 1.256 million to 1.320 million.

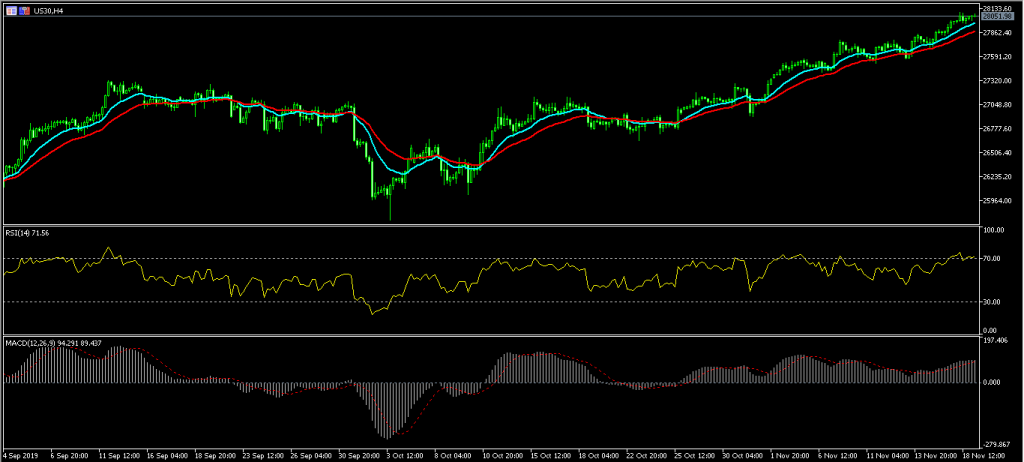

US30 Technical Analysis

The Dow Jones Industrial Average remains closed at its all-time high. The index is trading at $28055 and has gained by 20% YTD. The index is trading above the 14-day and 28-day moving averages while the RSI has risen to above the overbought level of 70. The signal line of MACD has continued to rise. The index may continue to rise although a pullback is also possible.

Euro Rises on Improving Sentiment

The euro rose against the USD as the market started being optimistic about the economy. Recent economic data has shown that while the European economy continues to struggle, it is making some improvements. This was confirmed by ECB’s financial stability review report that was released yesterday. The market will receive car registrations data from the region. The market will also receive industrial data from Italy. Meanwhile, the market will receive building permits and housing starts data from the US.

EUR/USD Technical Analysis

The EUR/USD pair has been on an upward trend since November 13, when it reached a low of 1.0988. This was along the 38.2% Fibonacci Retracement level on the four-hour chart. The price is trading at 1.1075, which is slightly lower than the previous high of 1.1090. This price is above the 61.8% Fibonacci Retracement level. The price is also slightly higher than the 14-day and 28-day moving averages while the RSI has moved to slightly below the overbought level of 70. The pair may continue moving upwards.

The post Australian Stocks Soar on Dovish RBA Minutes 19/11/19 appeared first on FP Markets.