[item_description],

EUROPEAN SHARES

All eurozone benchmarks opened significantly higher on Monday as the momentum on riskier assets remains strongly bullish momentum despite coronavirus cases continuing to rise over the weekend. As explained in previous reports, the recent positive macro data and potential development of a cure against the virus boosted market sentiment last week. However, the increasingly rapid spread of the virus over the last few days could prompt investors to temporarily slow their exposure to equities this week, or even take some profits, in the expectation of more policy support from central bankers. Having said that, the scenario of a deep downward correction on stock remains unlikely but the risk of a temporary consolidation cannot be ruled out.

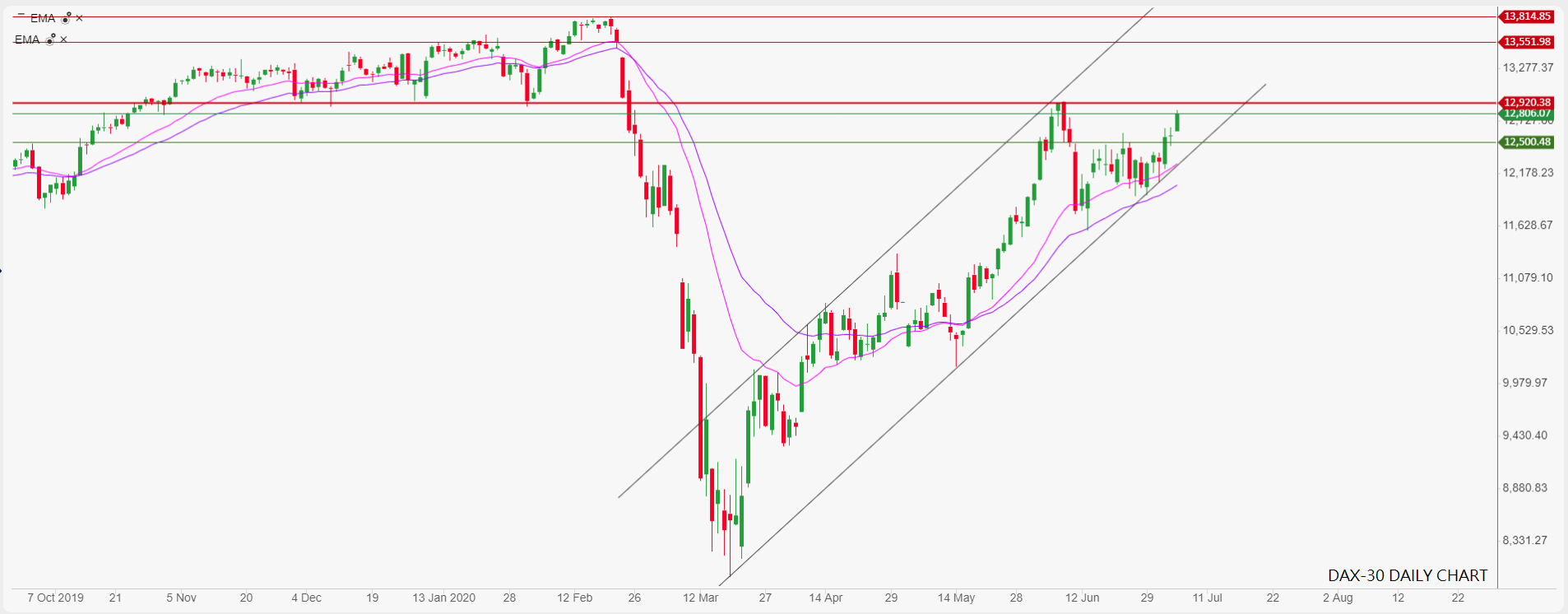

The DAX-30 Index is currently one of Europe’s top performers with today’s gains driven by the auto sector, with Daimler, BMW and Volkswagen top of the table. The market is now dancing around 12,800pts having successfully cleared the zone at 12,500pts. The next major resistance can be found near 12,920pts and a clearing of this level would open the way to an extended rally near 13,550pts and 13,815pts, or in other words to the pre-crisis levels.

Pierre Veyret– Technical analyst, ActivTrades

Disclaimer: opinions are personal to the authors and do not reflect the opinions of LeapRate. This is not a trading advice.

The post Daily market commentary: The DAX-30 Index is one of Europe’s top performers appeared first on LeapRate.

,