[item_description],

EUROPEAN SHARES

European share markets slid slightly lower on Tuesday as bullish market sentiment takes a break ahead of a busy upcoming few days with a slew of new macro data. Investors unsurprisingly seized the occasion brought by this morning’s disappointing German industrial production data to cash in some of their profits, following a six-day winning streak on stocks. Many traders are now returning their focus to the upcoming data, with Wednesday’s EIA crude oil inventory report as well as the highly anticipated US weekly jobless claims release on Thursday, ahead of earnings season where volatility spikes are usually expected. The current consolidation isn’t really threatening the bullish trend and could be qualified as a “temporary break” before registering fresh highs.

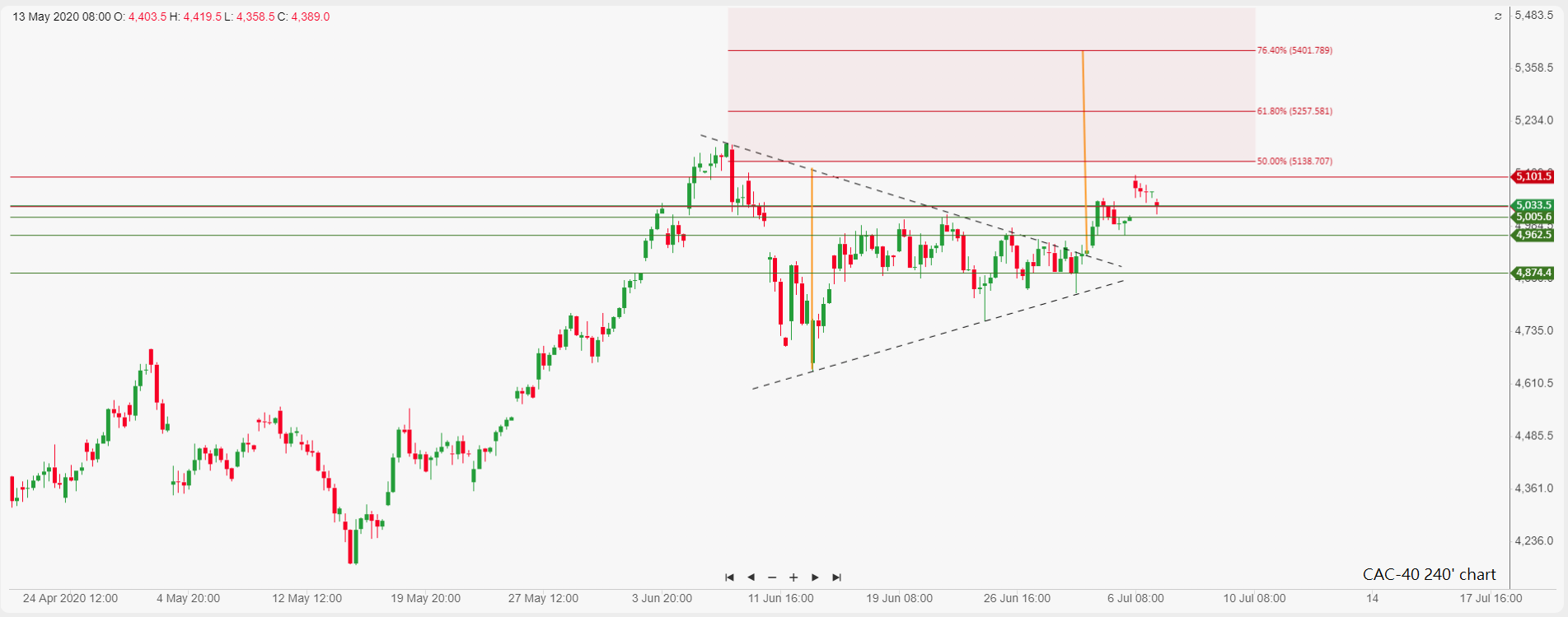

The French CAC-40 Index is still trading well above 5,000pts following a sharp spike above 5,010pts in early trading. The technical configuration remains bullish as the price hasn’t challenged any low support levels following the validation of the bullish triangle chart pattern. This is likely to send the market above 5,100pts towards 5,135-5,255pts with 5,400pts the final target on a short-term basis.

Pierre Veyret– Technical analyst, ActivTrades

Disclaimer: opinions are personal to the authors and do not reflect the opinions of LeapRate. This is not a trading advice.

The post Daily market commentary: The US dollar index is recording gains today appeared first on LeapRate.

,