[item_description],

Outlook

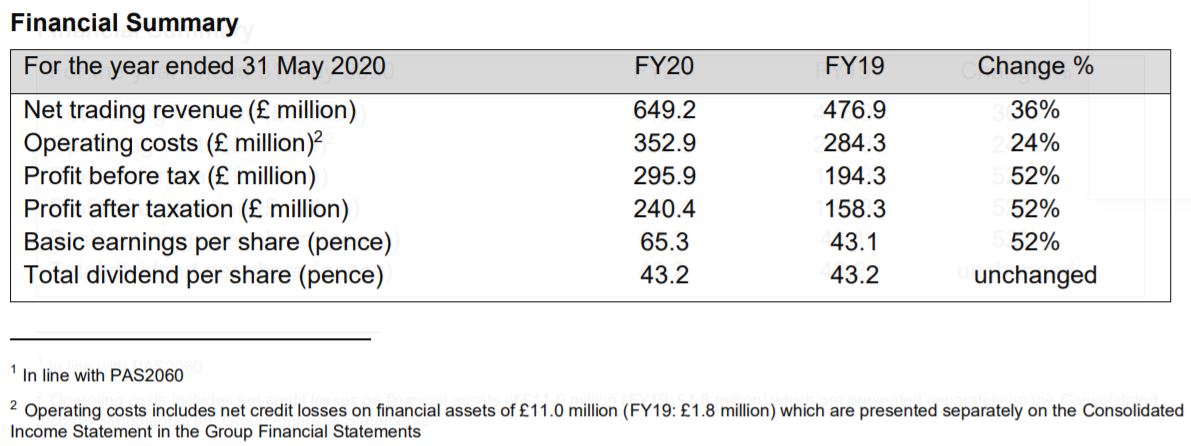

IG Group expects maintaining the momentum around the Core Markets and the portfolio of Significant Opportunities and to contain the progress it made in FY20. The targets remain the same: revenue growth in Core Markets of 3-5% over the medium term, and an incremental £100 million of revenue by the end of FY22 relating to the Significant Opportunities portfolio.

The company also said it expects more normalised levels of market volatility during the next financial year.

June Felix, Chief Executive, commented:

It’s been a successful first year in our three-year growth strategy to become a more sustainable, diversified, and global business. We concluded FY20 well on track to deliver on our medium-term targets and are confident in achieving the goals we’ve set. I’m delighted with the tangible progress we’ve made, the resilience we’ve shown as a company, and the record results we’ve delivered.

Our focus is on providing a first-class service to sophisticated clients wanting to trade our products across a range of global financial markets. IG’s continued investment in people and technology will further improve our platform and continue to deliver the new functionality and capabilities that our clients expect. Our clients are one of our most important stakeholders and our interests are aligned with theirs. Our success is built on their long-standing support and loyalty. In FY20, we experienced growing client demand across the world for IG’s products and services even prior to the exceptional period in Q4, and delivered record results.

The post IG reports successful financial year enhanced by Q4 market volatility appeared first on LeapRate.

,