Stockhome Forex Broker DEALS

Table of Contents

Stockhome Review | What Do you need to know about this broker?

Broker Type: STP

stockhome.io Leverage: 1:300

Regulation: none

Min. Deposit: US$250

HQ: St Vincent and the Grenadines

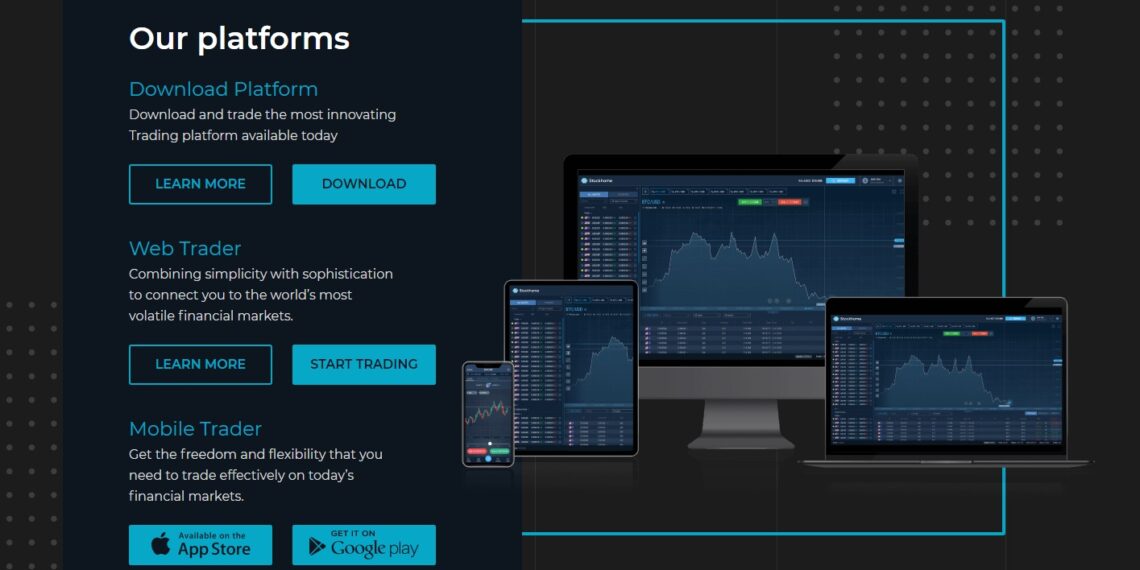

Platforms: Desktop, web-based – Mobile

Found in: 2021

Stockhome Social Channels and Contact Information

- Support: [email protected]

- Call Stockhome +44 1618180393

Stockhome.io Review ~ The partners at stockhome.io have a specific vision of offering tailored 1-to-1 trading services for clients who wish to put their hard earned money to work. Instead of allowing the interest to slowly build in a bank or building society, we want you to give your cash a chance to create higher profits.

This concept in the past few generations has a stigma attached to it whereby only large amounts of cash and successful business people could invest in stocks or trade foreign currencies. And it is still wrongly assumed still today by too many people, that large investment sums are needed.

With this in mind, stockhome.io set out to allow ANY person sitting at home or in the office, to be able to invest modest sums of money and offer them the 100% support and guidance needed for beginners. Confusing terminology and complicated technologies are not our things.

In 2021 Stockhome was launched and the trading platforms licensed. Liquidity was on standby and support managers at the ready.

Please note that trading the markets online with https://www.stockhome.io/ is EASY given all the tools we offer, but it also needs attention and smart trading to succeed.

Stockhome review | more details about Stockhome.io

Stockhome Review Company Profile

Stockhome is an unregulated and relatively new Forex, CFD and Cryptocurrency broker, established in 2021. .

They offer a good web-based trading platform – from EasyTech– . a negative point, they have a pretty small education section.

but today most new traders don’t learn from their broker but from a third party who is able to focus more on their education as it is their primary Business

Stockhome Review of their Trading Platform

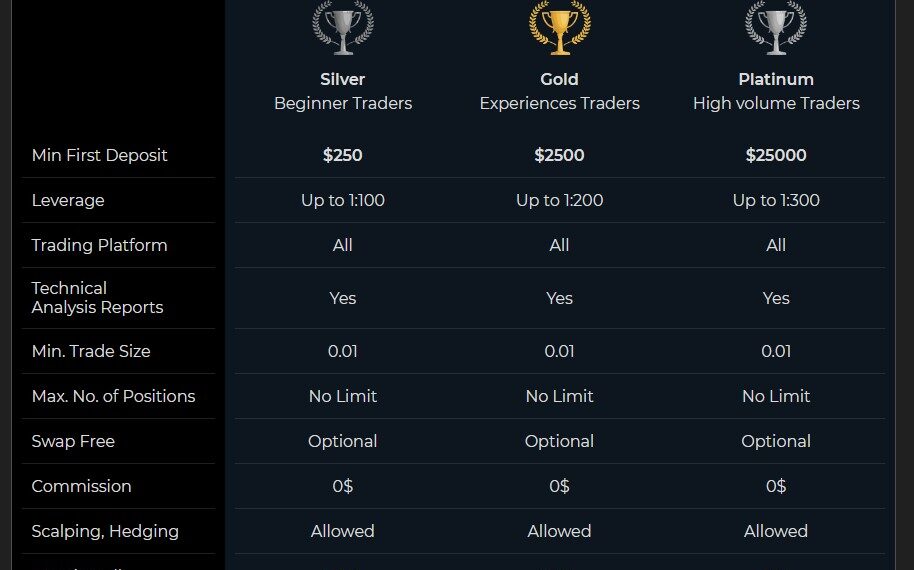

Account Types Stockhome

Opening your first forex account is one of the biggest steps you can make as a beginner trader, so it’s certainly not something you do unprepared.

Many beginner traders either rush into selecting an account type without properly understanding what it offers. Others become overwhelmed by the many different account types available..

Choosing a forex account type requires you to carefully consider a variety of things, including what type of forex trader you wish to be, your budget and your trading strategy. It’s important that you choose the right account for you, as your account type can impact your performance and profits.

since this broker offers many different accounts it is important to know what to look for.

first, let’s look at what they offer

All good forex brokers allow clients to choose from a multitude of types of trading accounts.

the most common live trading account types are based on the size of the lots you wish to trade. Considering this, each different type of account has a different minimum deposit level too.

Demo Accounts

Demo accounts allow you to practice your trading. They are virtual accounts loaded with virtual currency. the demo accounts are free. If you proceed to open a live account with the same broker, however, you will always have access also to your demo account in order to practice or test a strategy.

Demo accounts are useful for both beginners and experienced traders. Novice traders can use them to get to grips with different trading platforms and to see the effects of their trades in real-time. Experienced traders also use demo accounts to test their trading strategies risk-free.

Swap-free accounts

Most of the trading account types mentioned above will come with swap fees. This refers to the fee you incur for holding a position overnight. Traders who wish to hold positions open for a long time, however, such as swing traders or investors, suffer heavy fees with a regular account.

If you are a Muslim forex trader. Swap-free accounts are also sometimes called Islamic accounts. This is because they are often used by Muslim traders who cannot incur interest fees due to their religious beliefs.

How to Choose the Right Forex Account for You?

we are trailing of a bit in this Stockhome review but this is important to know:

Knowing the different types of Forex trading accounts only goes so far in helping you choose an account. ( see the table above) You also need to know your own situation well and know exactly what you want to get out of trading.

Before opening up a trading account, therefore, you need to ask yourself a series of questions:

- How much do I wish to deposit? This is a key question, as it can shrink your account options significantly. You need to weigh up how much capital you have, and how much of that you want to deposit with a broker. It is always worth remembering that you should never trade with money that you can’t afford to lose.

- What is my appetite for risk? One of the most important things you can do as a prospective trader is to assess your risk appetite. If you’re a conservative trader, for example, you may be quite happy with their educational account where you can trade and micro-lots. Those who wish to trade more aggressively may want to opt for a standard account where they can trade standard lots.

- Do I need access to advanced trading tools or premium assistance? some of their best services and best trading tools are saved for their professional clients. This may include innovative news analysis and direct access to the dealing room.

These are tools that can very beneficial to expert traders, who may be managing more than one account at once.

Stockhome.io Deposits and Withdrawals

One of the biggest concerns of traders is that the money transfers run smooth fast and cheap.

You can deposit and withdraw via wire transfer, credit cards, and a number of e-wallets but also with cryptocurrencies making it a true cryptocurrency broker

FAQ

No schema found.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. Concerning margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to leverage, creditworthiness, limited regulatory protection, and market volatility that may substantially affect the price or liquidity of a currency or related instrument. It should not be assumed that these products’ methods, techniques, or indicators will be profitable or will not result in losses.

The Review

Stockhome Forex Broker

In conclusion, Stockhome -Stockhome.io is a forex broker always looking to make your trading experience a better one.

PROS

- Intuitive trading platform

- Cryptocurrencies for trading

- easy to work with

- No restrictions on trading strategies

- Offers cryptocurrencies for Trading

CONS

- not regulate by European entity

- No MT4 or MT5

Review Breakdown

-

Trading experience

-

Assets to trade

-

Trading software

-

Security

-

Support

Stockhome Forex Broker DEALS

We collect information from many stores for best price available