Going into today’s election there is a slight ‘uneasiness’ about the whole thing and that there is a sense of déjà vu. Déjà vu about what you might ask, the Scottish Independence Vote and Brexit.

Both were unpredictable, both saw large swings in the currency but then diverged one played out as expected regarding the Scottish Independence Vote (SNV) the other Brexit did not.

Is today a mini referendum on ‘getting Brexit done’?

Table of Contents

Boris Johnson would like the UK voter to think so. Jermyn Corbyn would like the voter to concentrate on the state of public institutions such as the NHS.

With all 650 seats in the House of Commons up for grabs, the winning party needs 326 seats to get an absolute majority but that may not be the case today and why the market is starting to get a touch jittery.

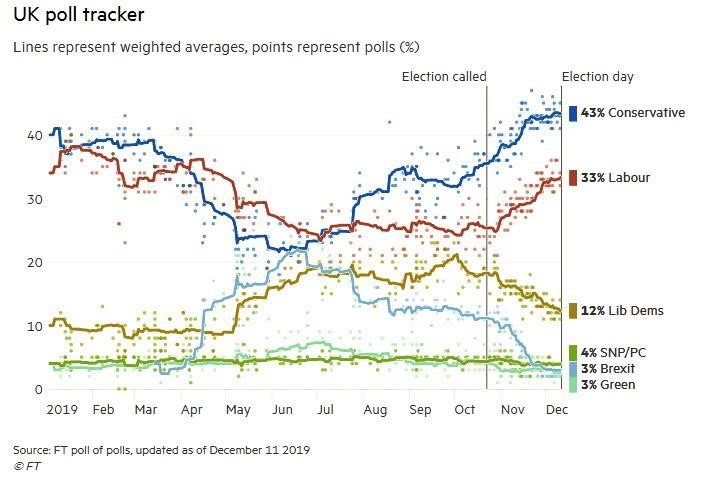

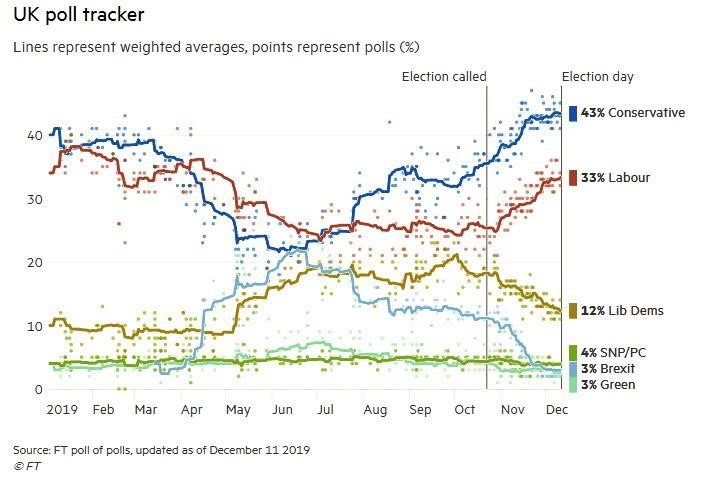

Here is the final FT poll of polls chart that captures all major poling to give a medium take on where the election might fall. The caveat being that polls of late have been horribly wrong.

Trading the timeline

Voting starts at 7:00 am GMT – 6:00 pm AEDT.

There will be some unofficial ‘polling’ in that small teams will survey voters as they leave polling stations but in the main during this time information will be limited. In the same situations for Brexit and SNV, the GBP eased through the voting day as the ‘risk’ of event saw people exit positions.

Polls close 10:00 pm GMT – 9:00 am AEDT

The Exit Poll – In the UK’s first past the post system this release is one of the most important of the day, it is a snapshot of what is expected to play out. It tends to be close to the mark, have it been wrong. At the 2017 election, this release was one of, if not, the largest mover of the GBP. The momentum created from here will be core to trading the day.

First results 10:30 pm GMT to 1:00 am GMT – 9:30 am to 12:00 am AEDT

Several small booths will be released inside 30 minutes after polls close most will be from north-west England and are likely to fall to the Labour Party (historical voting lines). The ones to watch that have substantial counts and are considered ‘bellwethers’ are Sunderland and Newcastle and they almost race to get out before each other.

If the race is won – 2 am GMT 1:00 pm AEDT

If all things remain equal – and the poll tracker is correct the counting of votes should finish by about 2:00 am and the winner declared the polls suggest a Conservative majority.

If it’s looking like the election could go down to the wire things will get interesting from here and the ‘time to declare’ could be pushed out significantly but all results will be declared by the end of December 13 in the UK (early December 14 in Australia). The longer this drags on the bigger the risk of a hung parliament and a clear sell signal for the GBP.

Trading the outcomes:

Conservatives win majority, ratifies Brexit, GBP is pricing this scenario in the most and would reinforce this trade.

Conservatives win but with minority, Brexit deadline of January 31 becomes a risk as a hard Brexit becomes a possibility as Brexiteers hold Johnson to account and opposition parties refuse to participate in its passing. GBP will fall if this comes to be tomorrow.

Hung Parliament with a Labour-led rainbow coalition, would see a second referendum as required by the Liberal Democrats, and a second Scottish Independence Vote as demanded by the SNP. Huge risk event – GBP would likely fall like a stone.

Labour wins majority, Brexit would come to a standstill, nationalisation of assets seen as a huge burden on the UK economy. GBP would likely collapse to Brexit lows.

The post Trading Election Day – GBP/USD appeared first on FP Markets.