Markets turned to growth at the beginning of the week, after US officials indicated that there is still a possibility of concluding a phase one of trade deal this year. Markets are encouraged by the fact that negotiations between the two largest world economies are still ongoing in general. This gives rise to hopes that the US may postpone December’s tariff hike, affecting $156 billion goods. Stock markets are moving cautiously upwards, while volatility continues to contract, which could be taken as an early signal for a possible future explosion of market volatility. This explosion could trigger both a deal and a new round of mutual tariff increases.

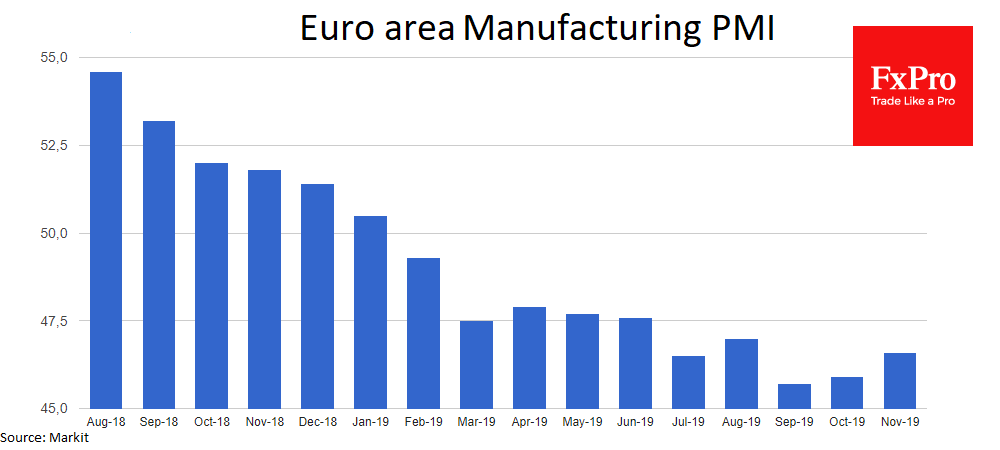

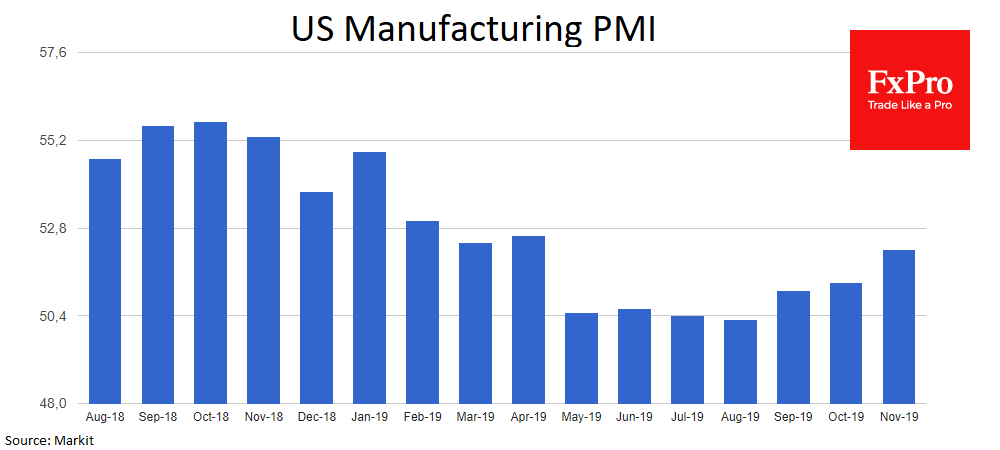

Interestingly enough, economic releases from the US continue to surprise with its strength. On Friday, we saw a stark contrast between Europe and the US, according to the business activity indices. In Europe, these indices stalled for the third month, only slightly exceeding 50, separating growth from decline. The manufacturing sector has been under the waterline since February. The decline in production is often followed by a general economic downturn a few quarters later.

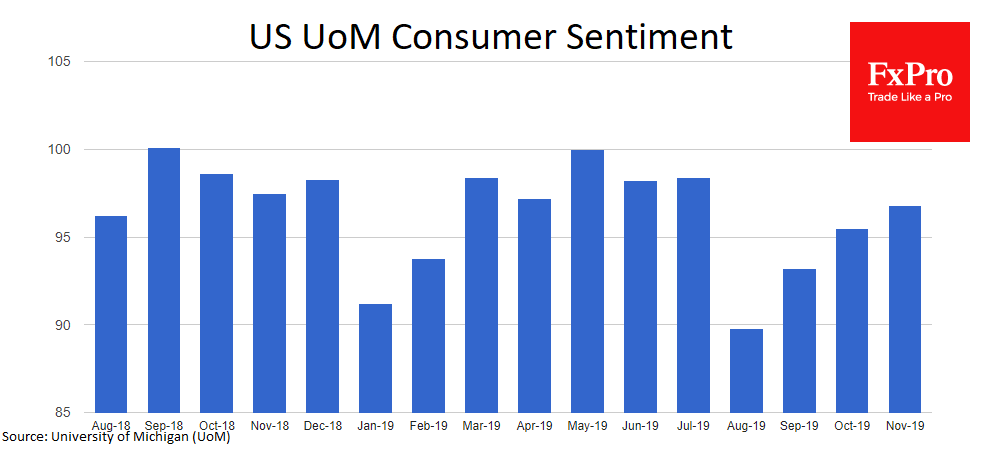

Consumer sentiment in the US is also improving in November, with the final November assessment released on Friday revised upwards and approaching July’s historically high levels. Contrast releases from the US and Europe show how responsive the US economy is to monetary stimulus, while in Europe, we are witnessing developing economic stagnation. This responsiveness of the US economy to a stimulus also allows stock markets to grow.

Sound US macro releases currently support the dollar, reinforcing the belief that the Fed will take a long pause in rate cuts. It is challenging to say the same about the eurozone, where we’re witnessing more and more signs of recession. Moving away from the very unpredictable and multifaceted US and China trade talks between, the difference in economic performance will play on the side of the dollar and against the euro and other European currencies. As long as the US is showing a recovery in growth rates to norm, Europe’s economic growth spark continues to fade quietly.

The FxPro Analyst Team