[item_description],

The unusually large amount of releases affecting GBPAUD this week means that traders should prepare for the possibility of significantly higher volatility. Short-term opportunities in both directions look likely ahead of the crucial Australian job data and claimant count change on Thursday.

Key data this week

Bold indicates the most important releases for this symbol.

- Tuesday 14 July, 1.30 GMT: NAB business confidence (June) – consensus -15, previous -20

- Tuesday 14 July, 3.00 GMT: Chinese annual imports (June) – consensus -10%, previous -16.7%

- Tuesday 14 July, 6.00 GMT: British balance of trade (May) – consensus -£800 million, previous £310 million

- Wednesday 15 July, 0.30 GMT: Westpac Consumer Confidence Index (July) – consensus 96, previous 93.7

- Wednesday 15 July, 0.30 GMT: Westpac Consumer Confidence Change (July) – consensus 2.5%, previous 6.3%

- Wednesday 15 July, 6.00 GMT: British annual inflation (June) – consensus 0.4%, previous 0.5%

- Thursday 16 July, 1.30 GMT: Australian employment change (June) – consensus 112,500, previous -227,700

- Thursday 16 July, 1.30 GMT: Australian unemployment rate (June) – consensus 7.4%, previous 7.1%

- Thursday 16 July, 2.00 GMT: Chinese annual GDP growth (Q2) – consensus 2.1%, previous -6.8%

- Thursday 16 July, 6.00 GMT: claimant count change (June) – consensus 250,000, previous 528,900

- Thursday 16 July, 6.00 GMT: British unemployment rate (May) – consensus 4.2%, previous 3.9%

- Thursday 16 July, 23.01 GMT: British Gfk consumer confidence (flash, July) – consensus -26, previous -30

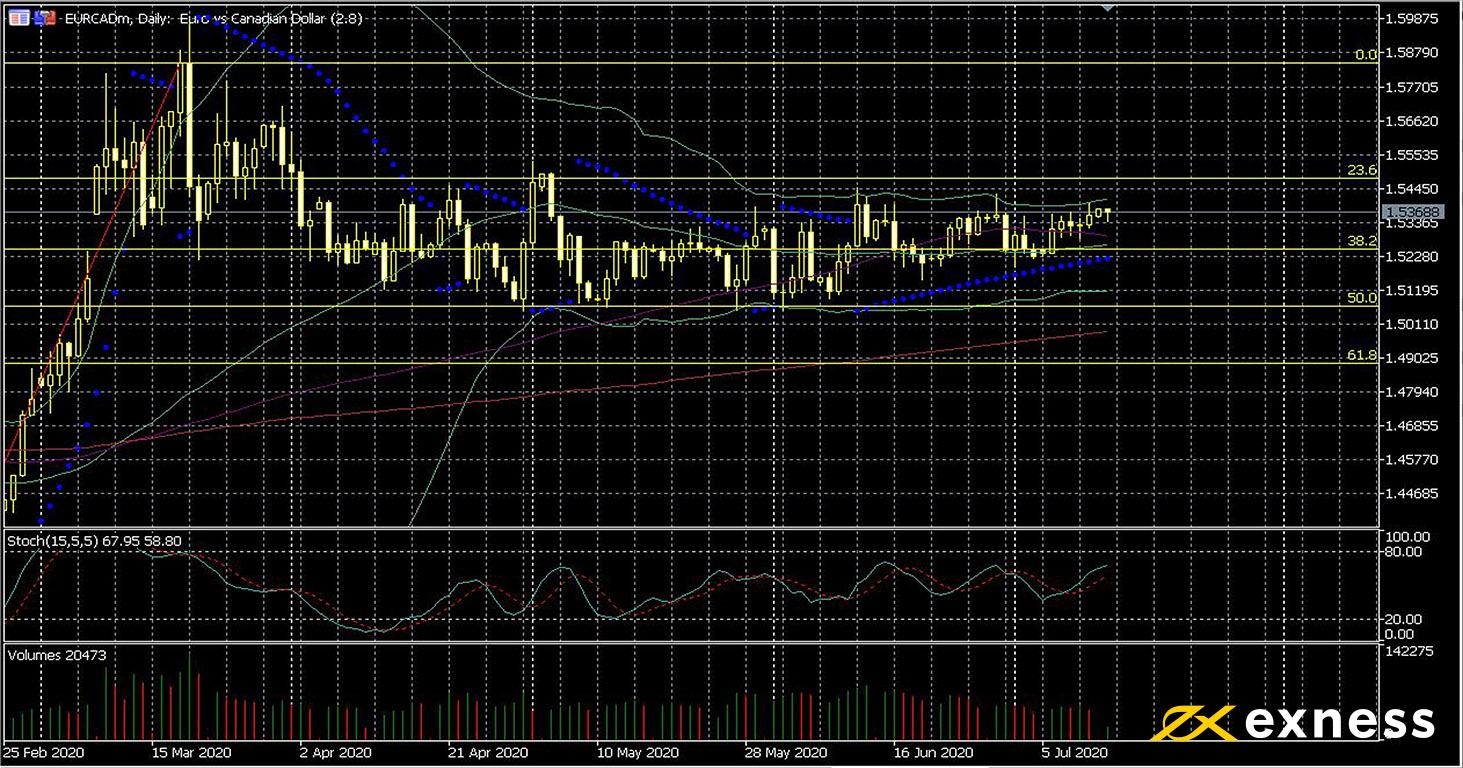

Euro-Canadian dollar, daily

The euro has stayed basically flat on the dailies against the loonie since the second half of April. Oil’s gains over the last two months have given fairly strong fundamental support to the loonie. Equally, though, data from the EU and particularly Germany hasn’t generally been as weak as expected over the same period. This morning’s news that Germany’s government thinks the worst is definitely over hasn’t given the euro much of a boost: most participants will probably be waiting for the crucial meetings of both central banks this week before committing themselves.

TA shows us an obvious channel between the 23.6% and 50% daily Fibonacci retracements. With no serious attempt to break through either of these, Bollinger Bands (50, 0, 2) have contracted sharply since April. Price remains above all three of the 50, 100 and 200 SMAs, so a bit more upward movement might be possible this week. Any breakout might be expected to continue given that the BoC and ECB are usually strong catalysts.

Key data this week

Bold indicates the most important releases for this symbol.

- Tuesday 14 July, 6.00 GMT: German annual inflation (final, June) – consensus 0.9%, previous 0.6%

- Tuesday 14 July, 9.00 GMT: ZEW economic sentiment (July) – consensus 60, previous 63.4

- Wednesday 15 July, from 14.00 GMT: meeting of the Bank of Canada

- Thursday 16 July, from 11.45 GMT: meeting of the European Central Bank

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: BoC and ECB in view appeared first on LeapRate.

,