[item_description],

Key data this week

Bold indicates the most important releases for this symbol.

- Monday 3 August, 13.45 GMT: American Markit manufacturing PMI (final, July) – consensus 51.3, previous 49.8

- Monday 3 August, 14.00 GMT: ISM manufacturing PMI (July) – consensus 53.6, previous 52.6

- Wednesday 5 August, 12.30 GMT: American balance of trade (June) – consensus -$50.3 billion, previous -$54.6 billion

- Thursday 6 August, from 6.00 GMT: meeting of the Bank of England

- Thursday 6 August, 12.30 GMT: initial jobless claims (1 August) – consensus 1.4 million, previous 1.43 million

- Friday 7 August, 12.30 GMT: non-farm payrolls (July) – consensus 1.65 million, previous 4.8 million

- Friday 7 August, 12.30 GMT: American unemployment rate (July) – consensus 10.5%, previous 11.1%

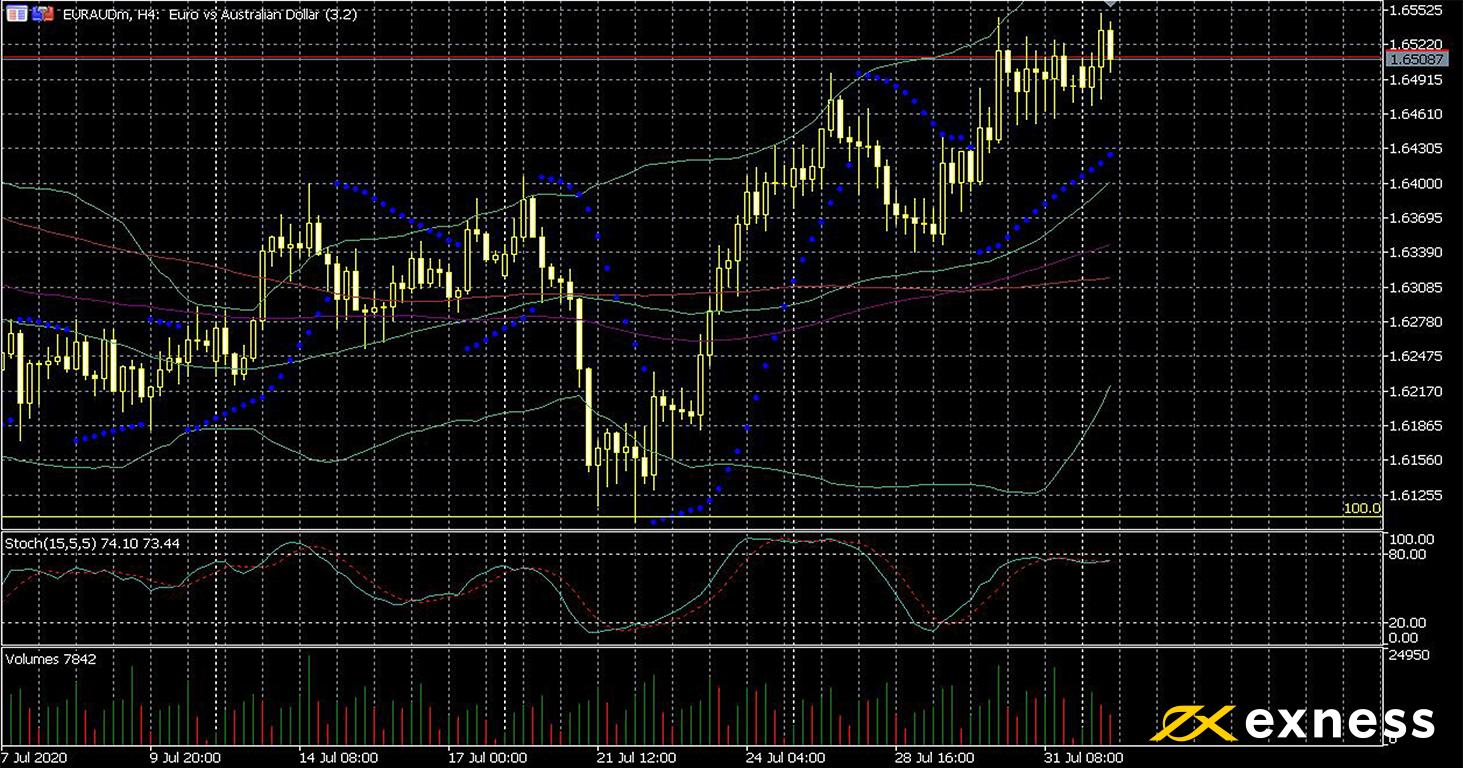

Euro-Aussie dollar, four-hour

The euro has continued to move up against the Australian dollar since last week, with one of the main reasons fundamentally being higher local rates of infection in Australia. The outlook for Australia remains strong given that the prices of various commodities are holding near annual highs in most cases. Governments are providing more stimulus in the eurozone, though, with the recent agreement among leaders of EU nations to provide an aid package to struggling southern nations giving the euro a boost in some of its pairs.

Seemingly the key catalyst for the euro’s latest gains here was the test of the 100% zone of daily Fibonacci retracement, i.e. a complete retracement of the common currency’s gains against the Aussie dollar since March. There’s no clear resistance on this timeframe. With moving averages having flipped to positive now – last week featured two golden crosses – some more gains might be expected this week. The key releases that could alter the technical picture are Australian balance of trade and the RBA’s meeting tomorrow morning plus German balance of trade on Friday.

Key data this week

Bold indicates the most important releases for this symbol.

- Tuesday 4 August, 1.30 GMT: Australian balance of trade (June) – consensus A$8.8 billion, previous A$8.03 billion

- Tuesday 4 August, 1.30 GMT: Australian retail sales (June) – consensus 2.4%, previous 16.9%

- Tuesday 4 August, from 4.30 GMT: meeting of the Reserve Bank of Australia

- Friday 7 August, 6.00 GMT: German balance of trade (June) – consensus €1.4 billion, previous €7.1 billion

- Friday 7 August, 6.00 GMT: German industrial production (June) – consensus 8.3%, previous 7.8%

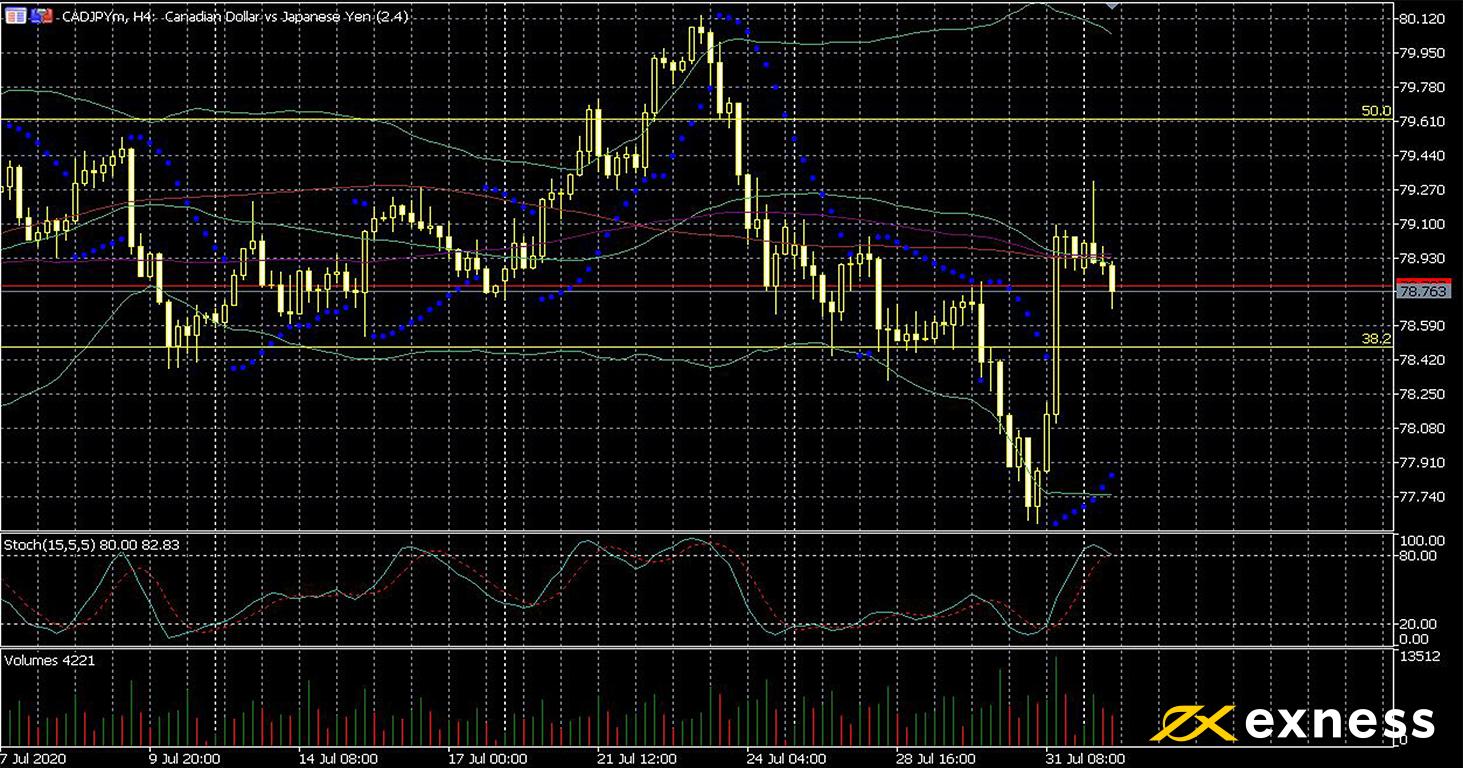

Canadian dollar-yen, four-hour

Canada’s economy has bounced back fairly well on the whole so far from the initial phase of the current crisis. However, GDP remains about 15% below where it was in February before covid-19 started to hit the country. American light oil remaining generally steady around $41 has given some support to the loonie recently. The yen’s strength last week came mainly as the Nikkei 225 fell fairly sharply to test two-month lows – the inverse correlation between these two remains strong.

CADJPY has been moving in a generally clear channel between the 50% and 38.2% daily Fibonacci retracement areas over about the last six weeks. So far there’s been no sustained movement beyond either of these areas. Buying volume increased significantly at the end of last week and the loonie also moved into overbought.

The main release this week set to interact with this chart is Wednesday’s balance of trade from Canada. Ivey PMI on Friday night will also probably be key, though. Volatility is expected to be high for every pair with CAD on Friday from 12.30 GMT as Canada releases a range of job data at the same time as the USA’s non-farm payrolls.

Key data this week

Bold indicates the most important releases for this symbol.

- Tuesday 4 August, 13.30 GMT: Canadian Markit manufacturing PMI (July) – consensus 48.6, previous 47.8

- Wednesday 5 August, 12.30 GMT: Canadian balance of trade (June) – consensus -C$900 million, previous -C$680 million

- Friday 7 August, 12.30 GMT: Canadian employment change (July) – consensus 400,000, previous 952,900

- Friday 7 August, 12.30 GMT: Canadian unemployment rate (July) consensus 11%, previous 12.3%

- Friday 7 August, 14.00 GMT: Ivey PMI (July) – consensus 57.5, previous 58.2

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: central banks and the NFP appeared first on LeapRate.

,