[item_description],

Key data this week

Bold indicates the most important release for this symbol.

- Thursday 23 July, 6.00 GMT: German GfK consumer confidence (August) – consensus -4.8, previous -9.6

- Thursday 23 July, 12.30 GMT: initial jobless claims (18 July) – consensus 1.29 million, previous 1.3 million

- Friday 24 July, 7.30 GMT: German Markit manufacturing PMI (flash, July) – consensus 48, previous 45.2

- Friday 24 July, 7.30 GMT: German Markit services PMI (flash, July) – consensus 50.3, previous 47.3

- Friday 24 July, 13.45 GMT: American Markit composite PMI (flash, July) – consensus 50.8, previous 47.9

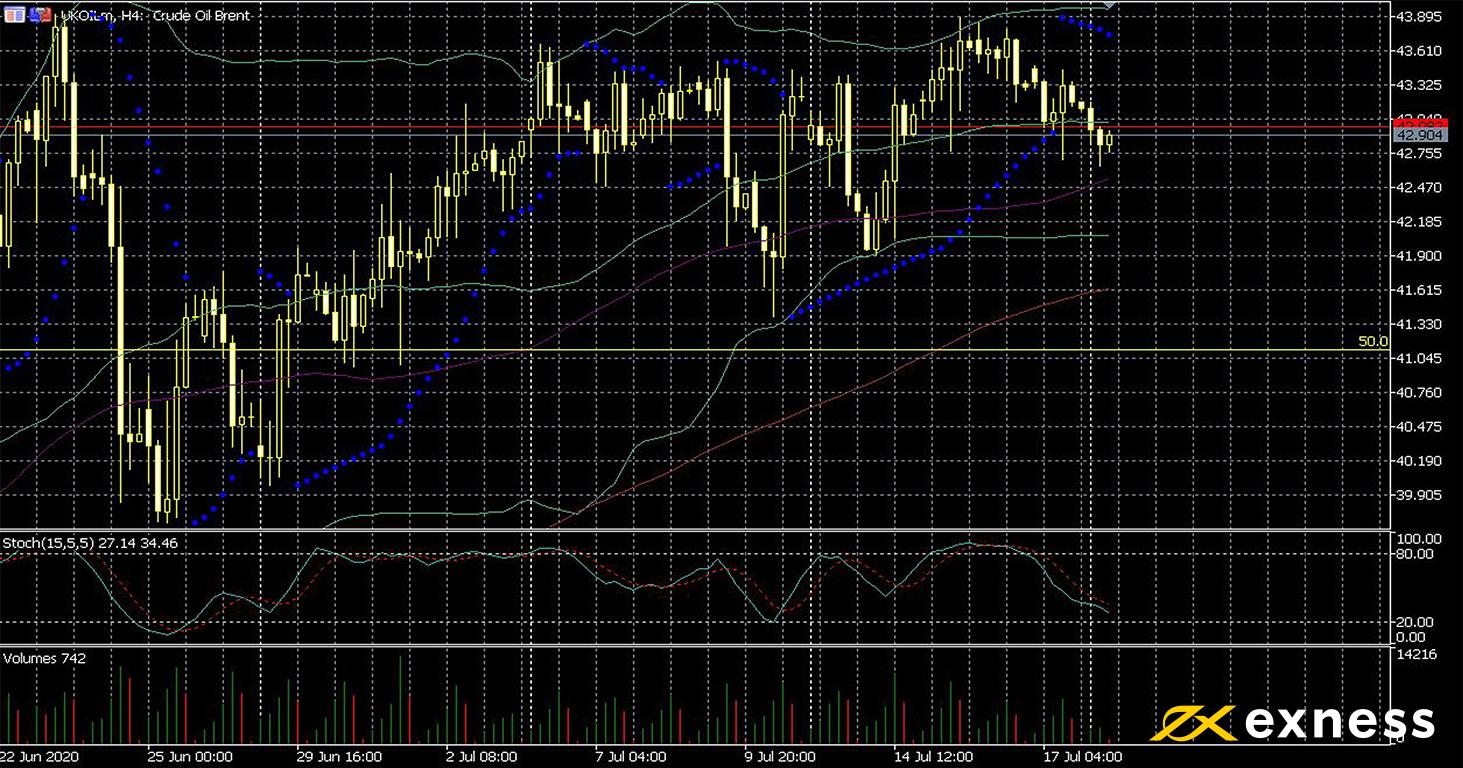

Brent, four-hour

‘Wait and see’ continues to be the dominant sentiment for both major benchmarks of crude oil so far this week. Traders are looking forward to an agreement among the EU’s leaders on the proposed aid as mentioned above while also monitoring fresh outbreaks of covid-19 in some southern states of the USA. Meanwhile OPEC+ agreed last week to scale back its current record supply cuts in August. From next month, around two million extra barrels per day will be released into markets.

Although this is an extended consolidation for Brent around $42-43, there is no clear evidence yet that the uptrend is over. The 50 and 100 SMAs are still functioning as supports and there has been no sustained movement below the 50% daily Fibonacci retracement area. A positive result from the EU’s negotiations could spur a retest of recent highs but traders will also be monitoring regular stock and rig data from the USA this week.

Key data this week

Bold indicates the most important release for this symbol.

- Tuesday 21 July, 20.30 GMT: API crude oil stock change (17 July) – previous -8.32 million

- Wednesday 22 July, 14.30 GMT: EIA crude oil stock change (17 July) – previous -7.49 million

- Friday 24 July, 17.00 GMT: Baker Hughes oil rig count (24 July) – previous 180

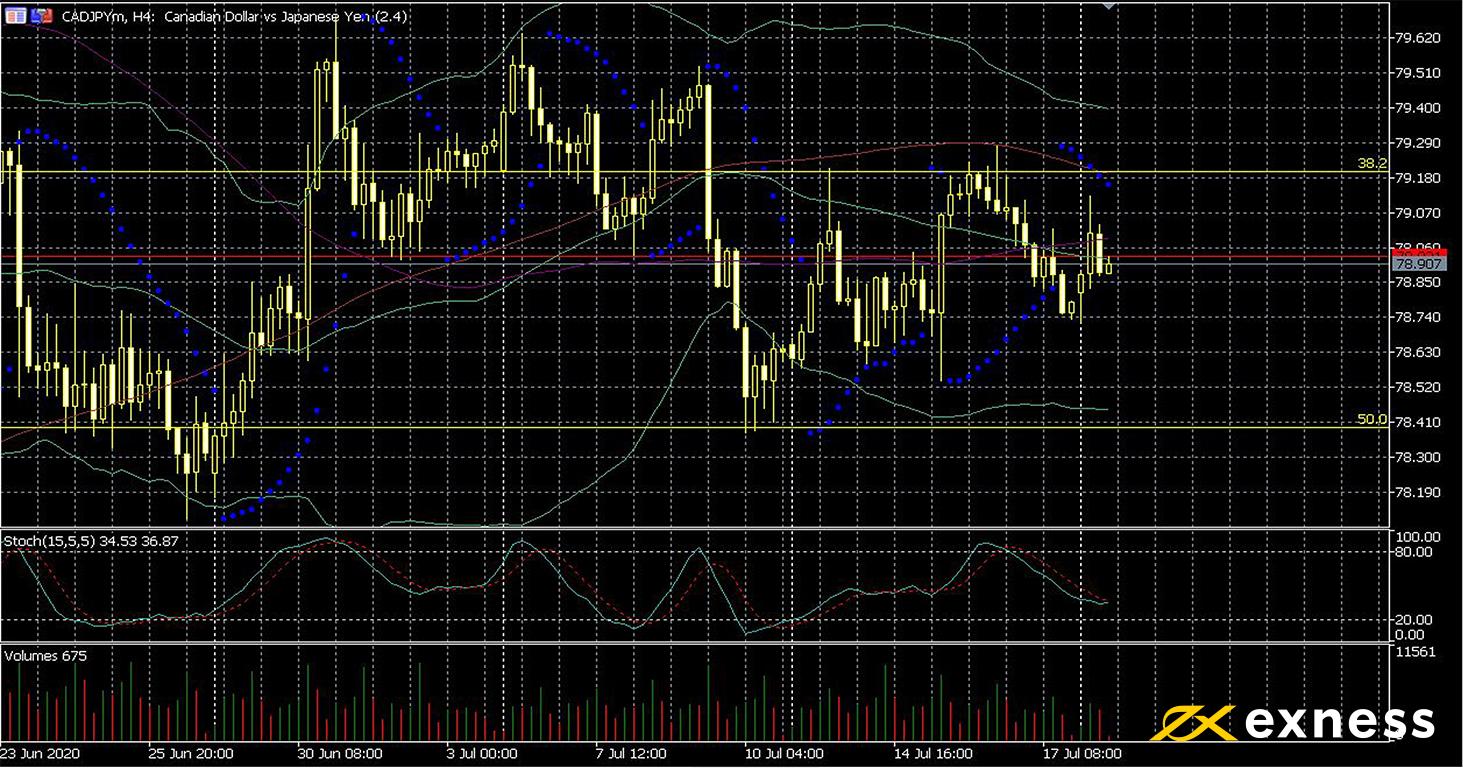

Canadian dollar-yen, four-hour

CADJPY hasn’t been especially active over the last fortnight as oil has held relatively steady and risk sentiment generally remains cautiously optimistic. Last week’s meeting of the BoC saw new governor Tiff Macklem confirm the central bank’s rationale of stimulus for a long time to return inflation to the target of 2%. Dr Macklem explained that this is clearly not a normal recession, so the BoC expects a long period of recovery before the economic picture looks similar to late 2019 again. Japan’s trade deficit decreased much less than expected in June as announced this morning and the figure for May was also revised down.

The loonie touched a weekly low against its southern counterpart in the aftermath of these remarks, but various other pairs like CADJPY were less affected. The technical picture here is pretty neutral. Moving averages have bunched together, volumes of both buying and selling remain fairly close to the average late in Q2 2020 and the slow stochastic is equidistant from neutral and oversold. Key data this week, notably inflation from both countries, could provide more direction. Equally, clear movement by crude oil could drive the Canadian dollar one way or the other depending on stock data.

Key data this week

Bold indicates the most important releases for this symbol.

- Monday 20 July, 23.30 GMT: Japanese annual inflation (June) – consensus 0.1%, previous 0.1%

- Tuesday 21 July, 12.30 GMT: Canadian retail sales (May) – consensus 20%, previous -26.4%

- Wednesday 22 July, 12.30 GMT: Canadian annual inflation (June) – consensus 0.3%, previous -0.4%

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: EU summit takes centre stage appeared first on LeapRate.

,