[item_description],

Key data points

Bold indicates the most important releases for this symbol.

- Wednesday 1 July, from 7.30 GMT: meeting of the Sveriges Riksbank

- Wednesday 1 July, 12.15 GMT: ADP employment change (June) – consensus 3 million, previous -2.76 million

- Thursday 2 July, 12.30 GMT: non-farm payrolls (June) – consensus 3.07 million, previous 2.51 million

- Thursday 2 July, 12.30 GMT: American balance of trade (May) – consensus -$52.4 billion, previous -$49.4 billion

- Thursday 2 July, 12.30 GMT: initial jobless claims (27 June) – consensus 1.36 million, previous 1.48 million

- Thursday 2 July, 12.30 GMT: American unemployment rate (June) – consensus 12.3%, previous 13.3%

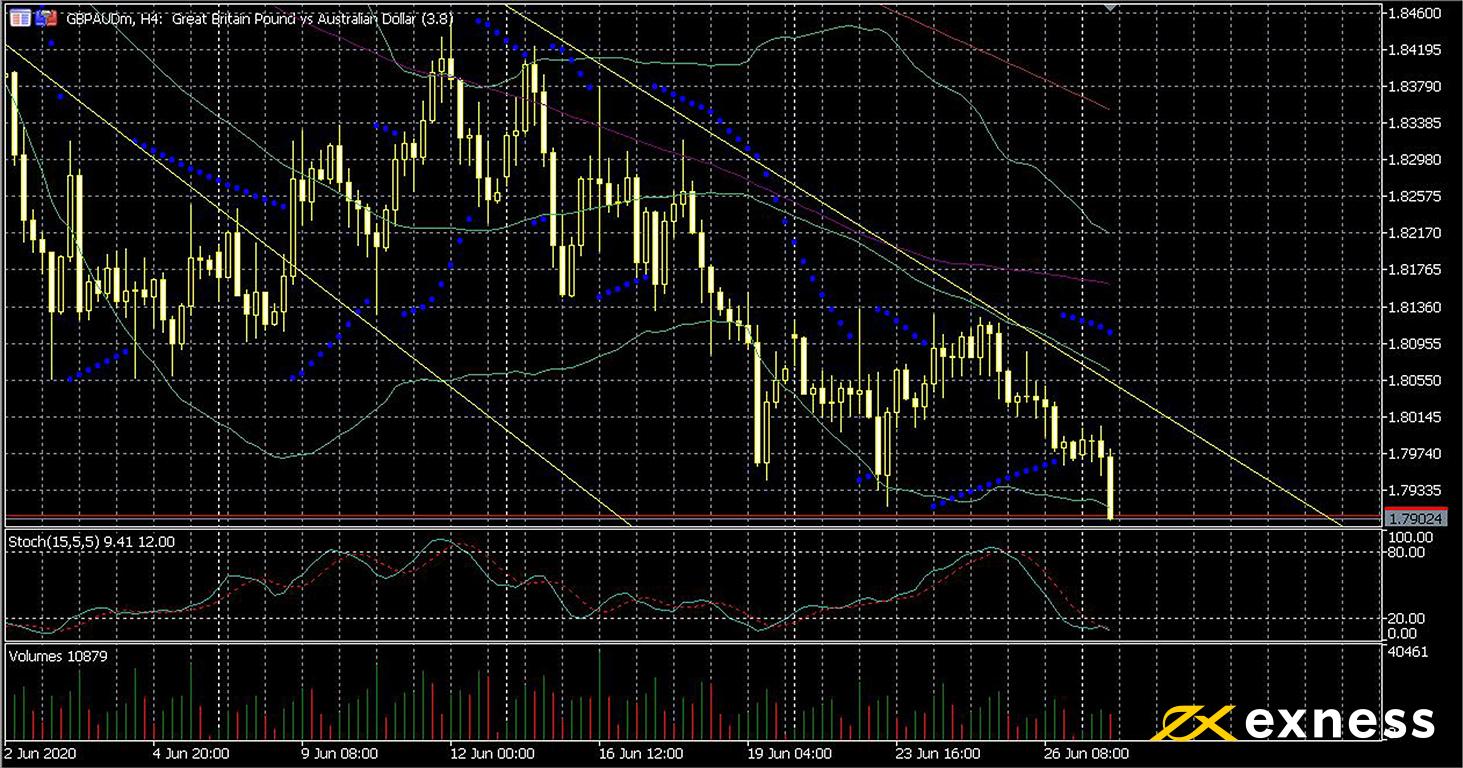

Pound-Australian dollar, four-hour

The pound has now lost about 20% of its value this year against the Australian dollar based on mid-January’s high. Among the most important factors weighing on the pound is the ongoing Brexit talks, specifically the likelihood of an Australian style trade deal if the talks fail, which would be little different from no trade deal in practical terms. The increase in recent infections in Leicester has also dented sentiment again as to the British government’s handling of covid-19. In Australia, though, Prime Minister Scott Morrison’s projections for economic growth are being intensively questioned by leading economists.

The picture from TA is very negative. GBPAUD reached a fresh 10-month low yesterday morning GMT at A$1.79. The 50 SMA from Bands has extended the gap again with the 100 today; it seems that the recent test of the 38.2% daily Fibonacci fan has failed for now. On the other hand, this symbol is clearly oversold based on both Bollinger Bands and the slow stochastic. The key release this week is Australian balance of trade early on Thursday, but Thursday night’s Gfk consumer confidence could also be important.

Key data points

Bold indicates the most important release for this symbol.

- Thursday 2 July, 1.30 GMT: Australian balance of trade (May) – consensus A$9 billion, previous A$8.8 billion

- Thursday 2 July, 23.01 GMT: British Gfk consumer confidence (final, June) – consensus -32, previous -36

- Friday 3 July, 1.30 GMT: Australian retail sales (May) – consensus 16.3%, previous -17.7%

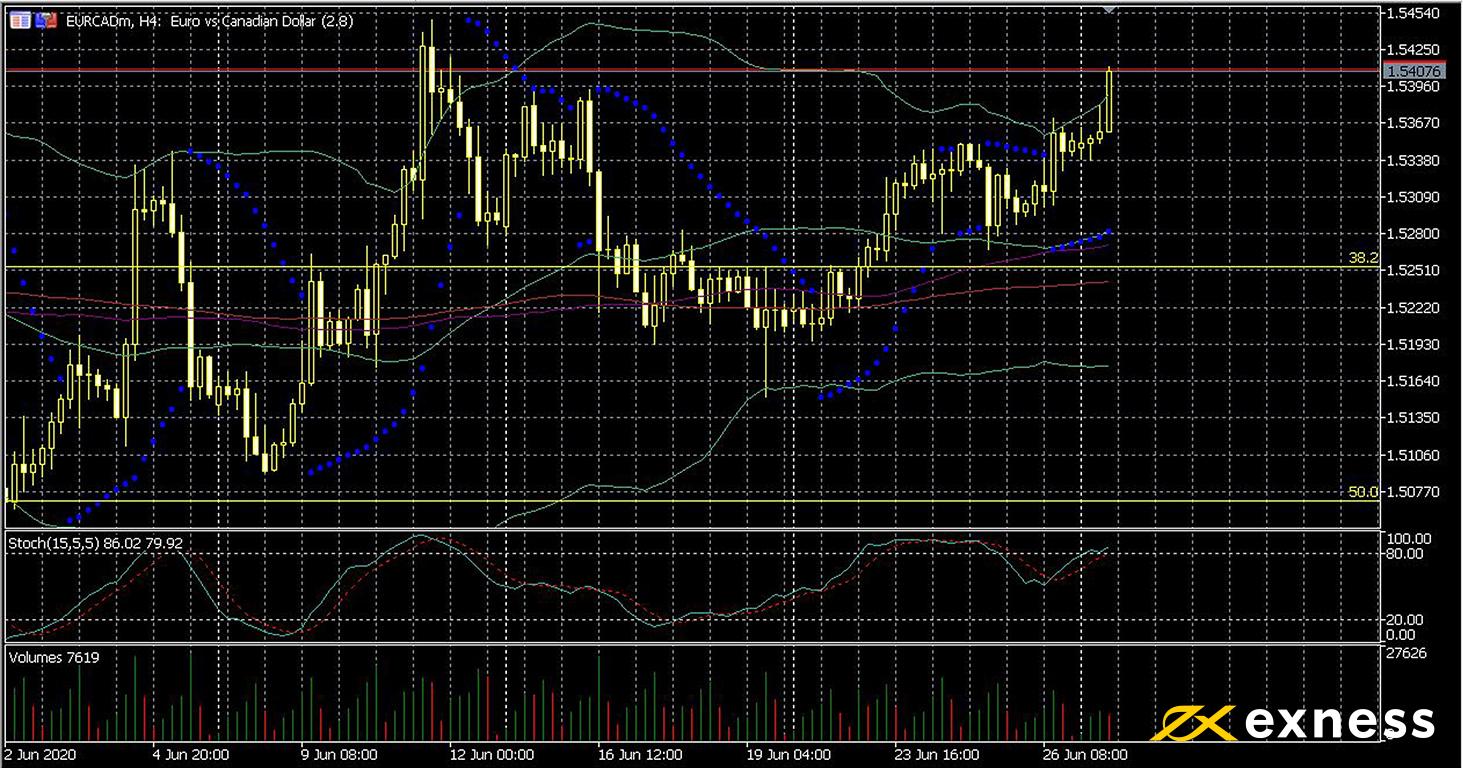

Euro-Canadian dollar, four-hour

The euro has made some gains in many of its pairs over the last week or so as easing of European lockdowns increasingly appears not to have been premature. Meanwhile the ECB’s President Christine Lagarde believes that the eurozone is over the worst of the economic hit from the coronavirus. The loonie on the other hand has faced some headwinds as a result of oil’s relatively deep retracement.

Monday’s gains appear to be an overextension. Price is overbought based on the movement outside the upper deviation of Bollinger Bands, and the slow stochastic at 86 also indicates overbought. The key resistance slightly below C$1.55 is approaching – this is the area of the 23.6% daily Fibonacci retracement. Declining average volume also suggests that a breakout here is unfavourable. That said, surprising data could change this impression, with the most important release being Canadian balance of trade on Thursday.

Key data points

Bold indicates the most important release for this symbol.

- Wednesday 1 July, 7.55 GMT: German unemployment change (June) – consensus 120,000, previous 238,000

- Thursday 2 July, 12.30 GMT: Canadian balance of trade (May) – consensus -C$3 billion, previous -C$3.25 billion

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: focus on the NFP appeared first on LeapRate.

,