[item_description],

Key data this week

Bold indicates the most important release for this symbol.

- Monday 27 July, 12.30 GMT: durable goods orders (June) – consensus 7.2%, previous 15.8%

- Wednesday 29 July, from 18.00 GMT: meeting of the Federal Open Market Committee

- Thursday 30 July, 12.30 GMT: American quarterly GDP growth (advance, Q2) – consensus -34%, previous -5%

- Thursday 30 July, 12.30 GMT: initial jobless claims (25 July) – consensus 1.4 million, previous 1.42 million

- Friday 31 July, 12.30 GMT: American personal income (June) – consensus -0.5%, previous -4.2%

- Friday 31 July, 12.30 GMT: American personal spending (June) – consensus 5.5%, previous 8.2%

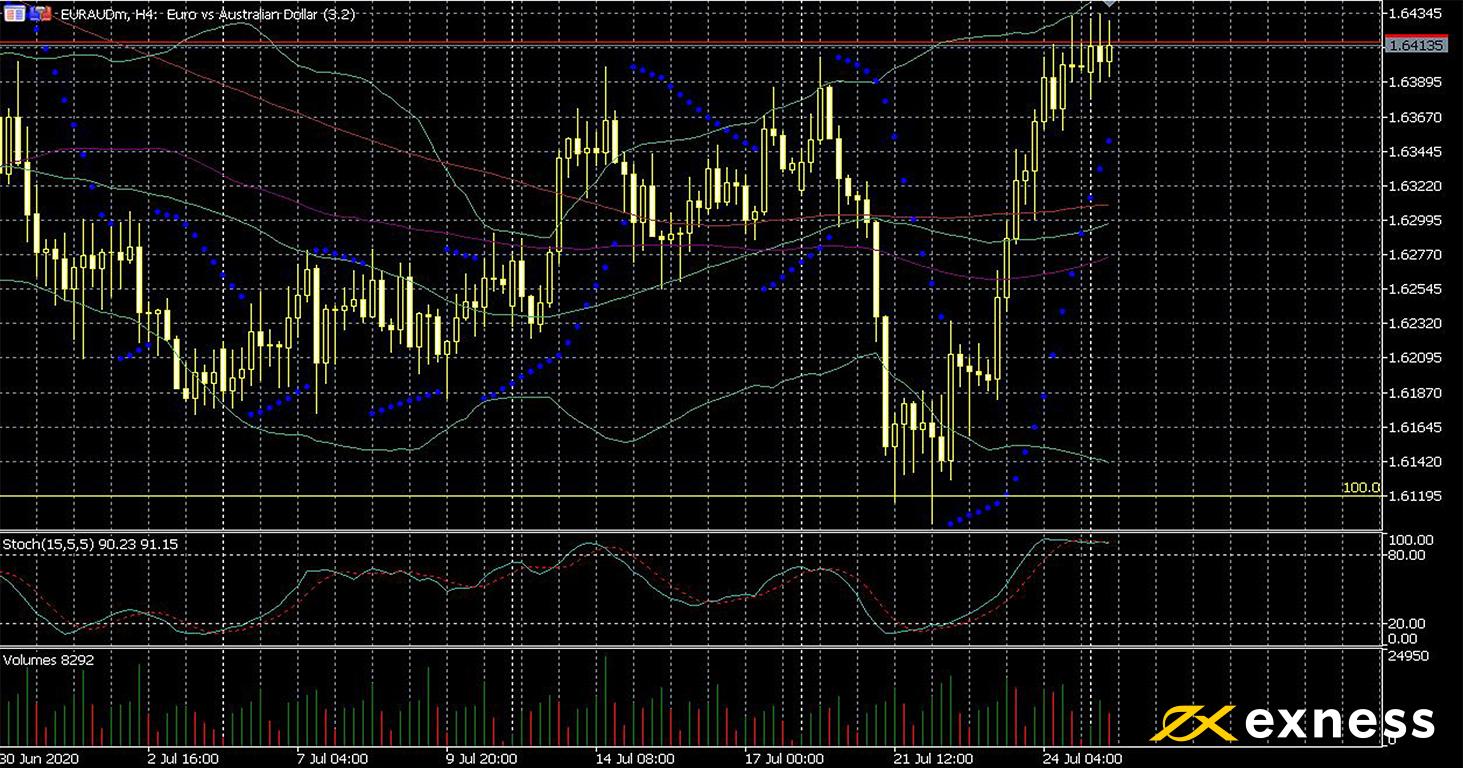

Euro-Aussie dollar, four-hour

A convergence of fundamental and technical factors has driven EURAUD’s bounce since the middle of last week. More new cases in China – the highest since April over the weekend – have hit sentiment and weakened the outlook for Australian exports. Meanwhile leaders in the eurozone agreed last week to a historic aid package for struggling Mediterranean economies.

The 100% Fibonacci retracement zone, i.e. full retracement of the euro’s gains in Q1, has now been established as a strong support. Unless the tone of the news suddenly turns very positive for Australia, we can expect another bounce if this area is tested again. Moving averages are somewhat mixed here, with the 50 SMA from Bands having recently completed a golden cross of the 100 but remaining below the 200. German GDP data is clearly the most important release for the euro-Aussie dollar this week, but Australian inflation early on Wednesday morning is also in view.

Key data this week

Bold indicates the most important releases for this symbol.

- Wednesday 29 July, 1.30 GMT: Australian annual inflation (Q2) – consensus -0.4%, previous 2.2%

- Wednesday 29 July, 1.30 GMT: Australian quarterly inflation (Q2) – consensus -2%, previous 0.3%

- Thursday 30 July, 7.55 GMT: German unemployment rate (July) – consensus 6.5%, previous 6.4%

- Thursday 30 July, 7.55 GMT: German unemployment change (July) – consensus 43,000, previous 69,000

- Thursday 30 July, 8.00 GMT: German annual GDP growth (flash, Q2) – consensus -10.9%, previous -2.3%

- Thursday 30 July, 12.00 GMT: German annual inflation (preliminary, July) – consensus 0.2%, previous 0.9%

- Friday 31 July, 1.30 GMT: Australian quarterly PPI (Q2) – consensus -1.8%, previous 0.2%

- Friday 31 July, 6.00 GMT: German annual retail sales (June) – consensus 0.8%, previous 3.8%

- Friday 31 July, 9.00 GMT: eurozone’s annual GDP growth (flash, Q2) – consensus -14.5%, previous -3.1%

- Friday 31 July, 9.00 GMT: eurozone’s annual inflation (flash, July) – consensus 0.2%, previous 0.3%

- Friday 31 July, 9.00 GMT: eurozone’s annual core inflation (flash, July) – consensus 0.7%, previous 0.8%

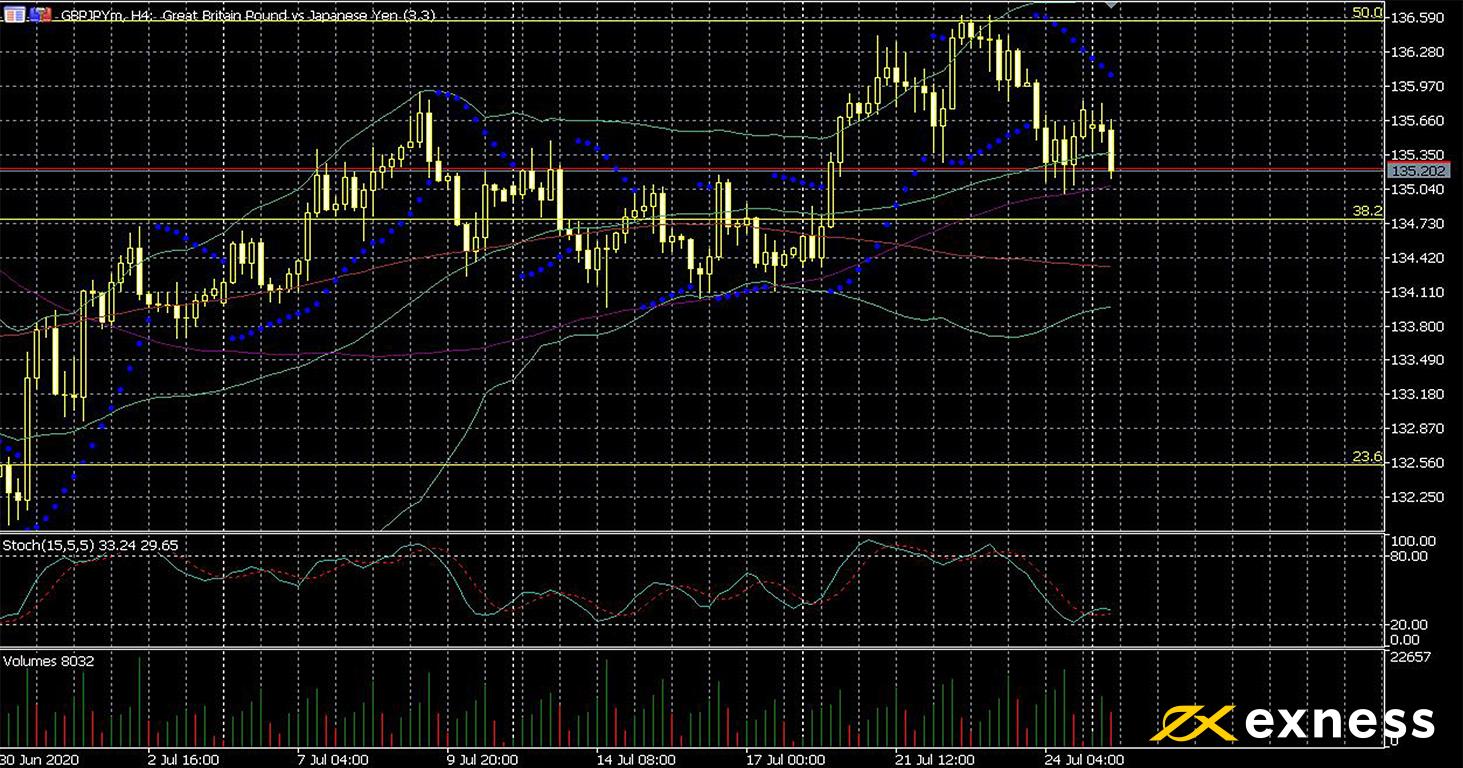

Pound-yen, four-hour

GBPJPY has yet to interact very clearly with the latest change in sentiment towards negative although it has retreated from its six-week high of 136.60 since last week. Fundamentals overall seem to favour the yen, but the relative recovery from the coronavirus in the UK has overshadowed some negative factors. Once markets again begin to price in a minimal at best British-EU trade deal, the pound seems to have some way to fall against most currencies.

The four-hour chart of pound-yen still shows a positive technical picture, though. The 50, 100 and 200 SMAs are successively above each other and below price, with the 100 having golden crossed the 200 last Tuesday morning GMT. Price is currently testing the 50 SMA with no real signs of selling strength from price action or volumes just yet. This week’s key data for GBPJPY are mostly Japanese, with the main event being consumer confidence on Friday morning.

Key data this week

Bold indicates the most important release for this symbol.

- Wednesday 29 July, 23.50 GMT: Japanese annual retail sales (June) – consensus -6.5%, previous -12.3%

- Thursday 30 July, 23.30 GMT: Japanese unemployment rate (June) – consensus 3.1%, previous 2.9%

- Friday 31 July, 5.00 GMT: Japanese consumer confidence (July) – consensus 26, previous 28.4

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: fresh all-time highs for gold appeared first on LeapRate.

,