[item_description],

Key data points

Bold indicates the most important release for this symbol.

- Tuesday 16 June, 20.30 GMT: API crude oil stock change (12 June) – previous 8.4 million

- Wednesday 17 June, 14.30 GMT: EIA crude oil stock change (12 June) – previous 5.72 million

- Friday 19 June, 17.00 GMT: Baker Hughes oil rig count (19 June) – previous 199

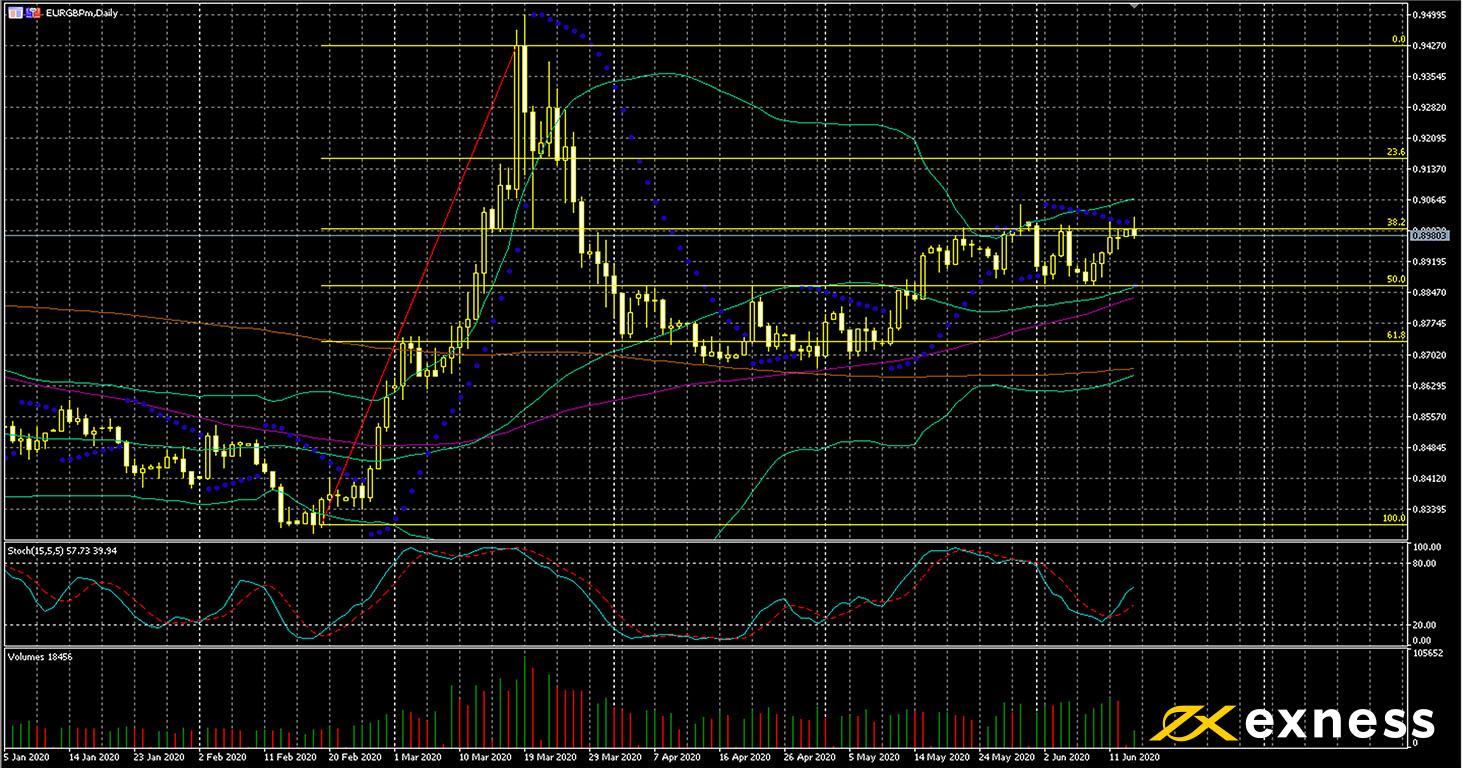

Euro-pound, daily

EURGBP has basically been directionless so far this month on the daily chart although volatility has been a bit higher than in April. The trajectory of covid-19 infections in the UK appears to be somewhat similar to Spain and Italy, so traders seem to expect significant improvement over the next few weeks. Meanwhile the British government continues to insist that it won’t apply for any extension to the Brexit transition period.

From a technical perspective, there appears to be a strong resistance around the 38.2% Fibonacci retracement area. This zone has withstood three tests since mid-May. Moving averages continue to indicate a buy signal, though, so any retracement downward on the lower timeframes might have limited potential over the next few days. Fundamentals are likely to be more in focus this week. Apart from crucial job data from the UK tomorrow, the BoE’s meeting on Thursday could also bring more direction to this symbol.

Key data points

Bold indicates the most important releases for this symbol.

- Monday 15 June, all day: EU-UK Brexit talks

- Tuesday 16 June, 6.00 GMT: claimant count change (May) – consensus 370,000, previous 856,500

- Tuesday 16 June, 6.00 GMT: British unemployment rate (April) – consensus 4.5%, previous 3.9%

- Tuesday 16 June, 6.00 GMT: German annual inflation (final, May) – consensus 0.6%, previous 0.9%

- Tuesday 16 June, 9.00 GMT: ZEW economic sentiment (June) – consensus 60, previous 51

- Wednesday 17 June, 6.00 GMT: British annual inflation (June) – consensus 0.5%, previous 0.8%

- Thursday 18 June, from 11.00 GMT: meeting of the Bank of England

- Friday 19 June, 6.00 GMT: German PPI (May) – consensus -0.3%, previous -0.7%

- Friday 19 June, 6.00 GMT: British annual retail sales (May) – consensus -17.3%, previous -22.6%

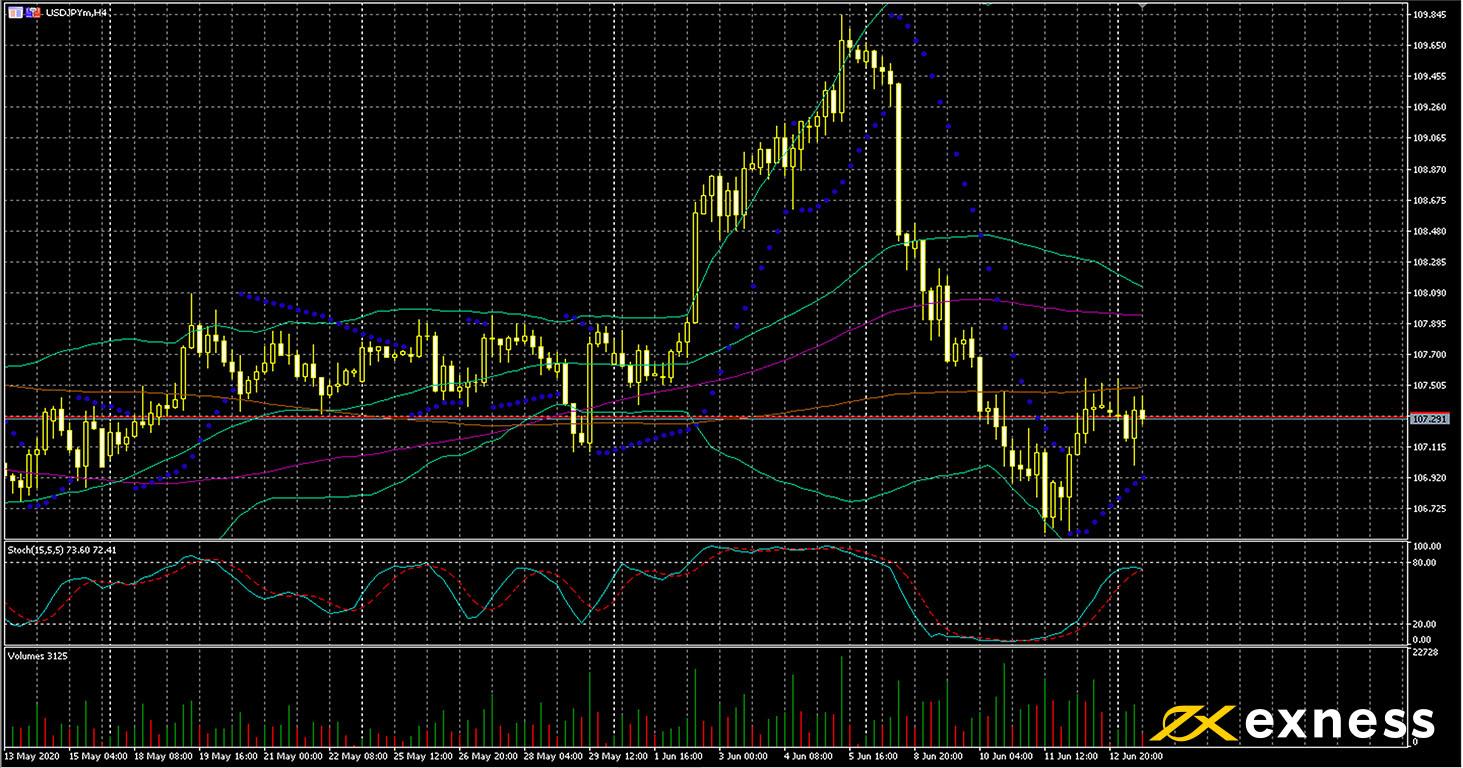

Dollar-yen, four-hour

USDJPY is usually one of the most affected symbols by volatility in stock markets, and the past fortnight has been no exception to this. Strong gains came in the first week of June as USTEC posted new record highs and other indices generally made gains, but losses occurred last week as all significant indices around the world retreated from their latest highs, in some cases quite sharply.

The extent of last week’s reversal seems to be excessive based on TA. Price is now below all three of the 50, 100 and 200 SMAs and the first two are likely to death cross within the next few days. Buying volume though remains very high compared with the average in May. There’s a number of important releases from Japan this week plus American retail sales that might drive a clearer direction in the short term. Buyers though should watch out for saturation given that the slow stochastic currently reads 74, very close to overbought.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 16 June, from 3.00 GMT: meeting of the Bank of Japan

- Tuesday 16 June, 12.30 GMT: American retail sales (May) – consensus 8%, previous -16.4%

- Tuesday 16 June, 23.50 GMT: Japanese balance of trade (May) – consensus -¥970.8 billion, previous -¥930 billion

- Thursday 18 June, 12.30 GMT: initial jobless claims (13 June) – consensus 1.28 million, previous 1.54 million

- Thursday 18 June, 23.30 GMT: Japanese annual inflation (May) – consensus 0.3%, previous 0.1%

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.

The post Weekly data preview: more losses for shares; covid’s second wave feared appeared first on LeapRate.

,