US stocks rose for the first tie in three days as traders placed their hopes on the trade negotiations in Washington. The negotiations between Liu He and US representatives are set to commence today. This is five days before the new round of tariffs are scheduled to go into effect. Yesterday, the Chinese offered to increase their purchases of US farm goods in a bid to reduce the trade surplus. While a bigger trade deal is not expected, traders hope that a narrow agreement will help reduce tensions. This comes at a time when the Fed and other market watchers warn that a recession could be on the horizon.

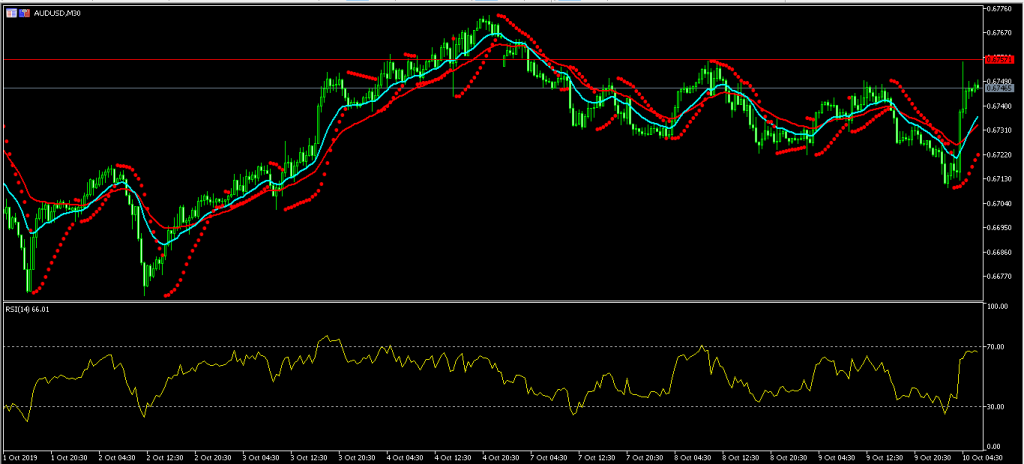

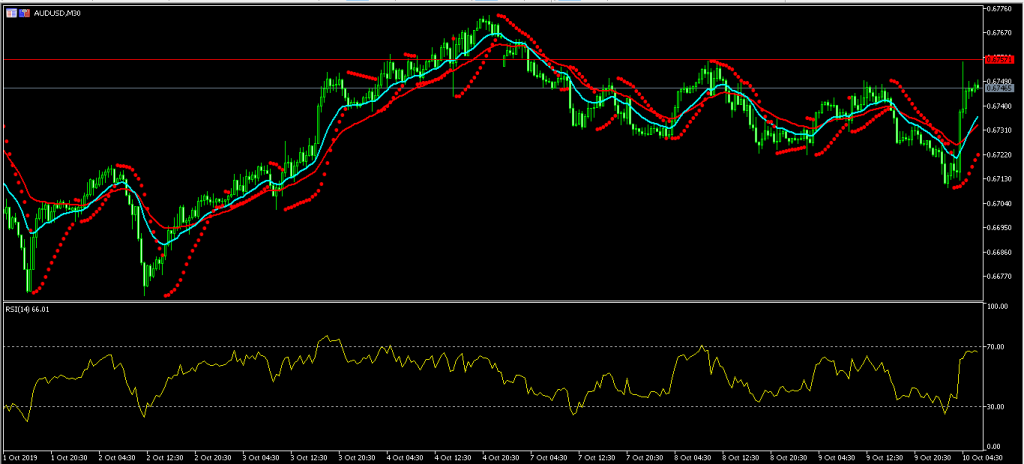

The AUD/USD pair, which is watched closely in terms of China-related trade rose to a high of 0.6756 from a low of 0.6710. On the 30-minute chart, the price is above the 14-day and 28-day moving averages while the RSI has moved sharply higher to almost 70. The Parabolic SAR dots remain below the price, which is an indicator that it might continue to move higher. The price could continue to move higher.

US dollar. The US dollar was relatively unchanged against its peers after the Federal Reserve released minutes of the previous meeting. The minutes showed that members debated on how far their interest-rate cutting process should extend. Some members pushed the committee to signal to the market that the easing cycle was nearing its end. As such, traders interpreted this to mean that the Fed could slash rates again later this month. The minutes came a day after the Fed chair said that the bank was considering expanding its balance sheet. Later today, traders will receive CPI and initial jobless claims numbers from the US.

The EUR/USD pair rose yesterday to a high of 1.0990, which was higher than the important resistance level of 1.0980. On the 30-minute chart, this price is slightly lower than the upper line of the Bollinger Bands. The signal and main line of the Relative Vigor Index (RVI) are above the neutral line. There is a possibility that the pair will continue moving higher to retest the important resistance level of 1.1000.

Sterling. Sterling rose against the USD and EUR in overnight trading after Michel Barnier and Jean-Claude Juncker expressed their hopes of a Brexit deal. This came shortly after the UK government started a blame campaign against the EU after talks ended. The UK has blamed the EU of seeking to divide the country by insisting that Northern Ireland be left to remain in the EU Customs Union. Later today, the UK will release important data. The first reading of the third quarter GDP is expected to show that the economy expanded by 0.9%. This will be lower than the second quarter increase of 1.3%. Manufacturing production in August is expected to fall from 0.3% to 0.1% while industrial production is expected to have declined by -0.1%.

The GBP/USD pair rose slightly to a high of 1.2230 during the Asian session. This was a bit higher than yesterday’s low of 1.2195. On the 30-minute chart, this price is slightly above the 14-day and 28-day moving averages. The pair might move to test the 23.6% Fibonacci Retracement level of 1.2247.

The post Australian dollar jumps as US-China trade talks begin 10/10/19 appeared first on FP Markets.