[item_description],

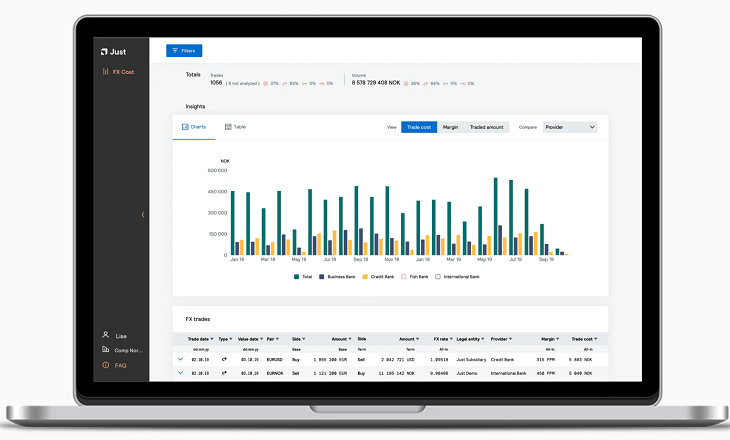

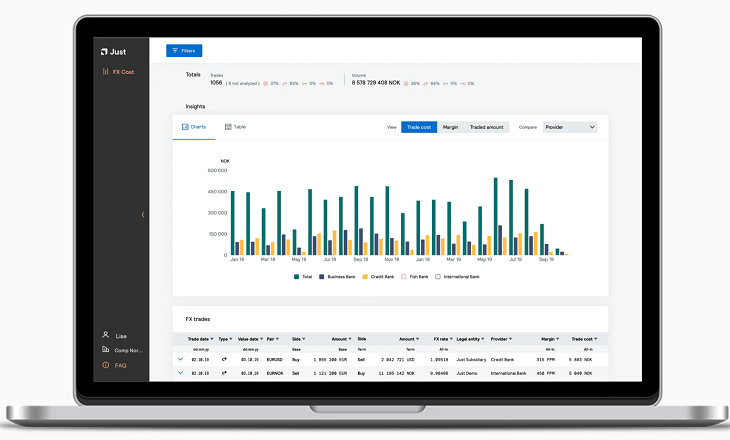

Typically, banks and brokers trade with low execution fees and instead their revenue is generated by marking up the bid/offer spread. A lack of transparency in this can mean discriminatory pricing, but with a market that is fast moving and not centrally cleared, understanding the scale of this additional margin can be challenging.

Anders Nicolai Bakke, founder and CEO of Just, said:

Since our launch last year, we have analysed more than $40 billion in traded flow between companies and banks, and built a strong reputation in the Nordic market. Clients have been able to make significant savings on their foreign currency transaction costs as intermediaries are forced to be transparent with their fees. SugarCane is our first partner in the UK, and we look forward to working with them to ensure their clients benefit from the significant cost savings which are delivered by Just.

Robert Brown, added:

We know that the most sophisticated clients get better FX pricing from their intermediaries. For those SMEs currently using banks for their brokerage needs and who are doing at least £30m worth of FX turnover each year, this collaboration ensures they have access to the very highest quality trade tools which will in turn significantly reduce their transaction costs. In the event clients aren’t seeing a saving, we will refund the annual license fee in full.

The post SugarCane Capital teams up with FX market analytics provider Just to provide transparency appeared first on LeapRate.

,